Luxury Auto Limits: Which Vehicles Qualify for Tax Restrictions

Understanding luxury auto limits

When purchase a vehicle for business use, not all automobiles are treated as by the IRS. Luxury auto limits represent specific thresholds establish by the internal revenue service that restrict the amount of depreciation and lease expense deductions available for high price vehicles. These limitations were design to prevent businesses from use expensive luxury vehicles as tax write-offs.

The luxury auto limits apply to passenger automobiles, trucks, and vans that exceed certain price thresholds. Understand which vehicles fall under these restrictions is essential for business owners and professionals who use vehicles for business purposes.

Which vehicles are subject to luxury auto limits?

The IRS apply luxury auto limits to what it classifies ” ” passenger automobiles. “Thiss categoryincludese:

- Four-wheel vehicles mainly design for public streets, roads, and highways

- Vehicles with an unloaded gross weight of 6,000 pounds or less

- Sedans, coupes, convertibles, and nearly standard SUVs

- Crossover vehicles

- Smaller pickup trucks and vans

Fundamentally, most conventional cars and smaller SUVs fall under these limitations. The restrictions apply disregarding of the vehicle’s brand, model, or actual purchase price the classification is base mainly on the vehicle’s weight and intended use.

Source: bantacs.com.au

Vehicles exempt from luxury auto limits

Not all vehicles are subject to these restrictions. Several types of vehicles are specifically exempt from luxury auto limits:

Heavy SUVs, trucks, and vans

Vehicles with a gross vehicle weight rating (gover)exceed 6,000 pounds are not subject to luxury auto limits. This inincludesany:

- Full size pickup trucks (ford f 150, cChevrolet Silverado ram 1500, etc. )

- Large SUVs (cCadillac Escalade cChevroletsuburban, ford expedition, etc. )

- Full size vans (ford transit, mMercedes-Benzsprinter, etc. )

This exemption has created what many tax professionals refer to as th” SUV loophole,” allow businesses to potentially deduct the full cost of qualify heavy vehicles in the first year through bonus depreciation or section 179 expensing ((ubject to certain limitations ))

Specialized business vehicles

Vehicles that are specifically modified for business use and not likely to be use for personal purposes are broadly exempt from luxury auto limits. These include:

- Vehicles with permanent shelving install

- Vehicles with company logos permanently paint on the exterior

- Delivery trucks and vans with no seating behind the driver’s seat

- Ambulances and hearses

- Taxis and other vehicles use for transport people or property for hire

Qualified non-personal use vehicles

Certain vehicles that are not likely to be use for personal purposes due to their design are exempt from luxury auto limits:

- School buses

- Cement mixers

- Dump trucks

- Garbage trucks

- Refrigerated trucks

- Flatbed trucks

- Specialized utility repair trucks

The impact of luxury auto limits on depreciation

For vehicles subject to luxury auto limits, the IRS set maximum depreciation deductions that can be claim each year. These limits are adjusted yearly for inflation and apply disregarding of the actual cost of the vehicle.

The luxury auto limits importantly restrict how rapidly businesses can recover the cost of more expensive vehicles through tax deductions. For example, while a $60,000 vehicle subject to luxury auto limits might take several years to amply depreciate, a likewise price heavy sSUVover 6,000 pounds might be eligible for practically more accelerated depreciation.

Current depreciation limitations

The IRS update the maximum depreciation limits yearly. The limits are applied on a year by year basis:

- First year of service: limited to a specific dollar amount

- Second year of service: different, typically higher limit

- Third year of service: another specify limit

- Fourth and subsequent years: final specify limit until the vehicle is full depreciate

These limitations mean that expensive vehicles subject to luxury auto limits will take importantly yearn to amply will depreciate will compare to other business assets or exempt vehicles.

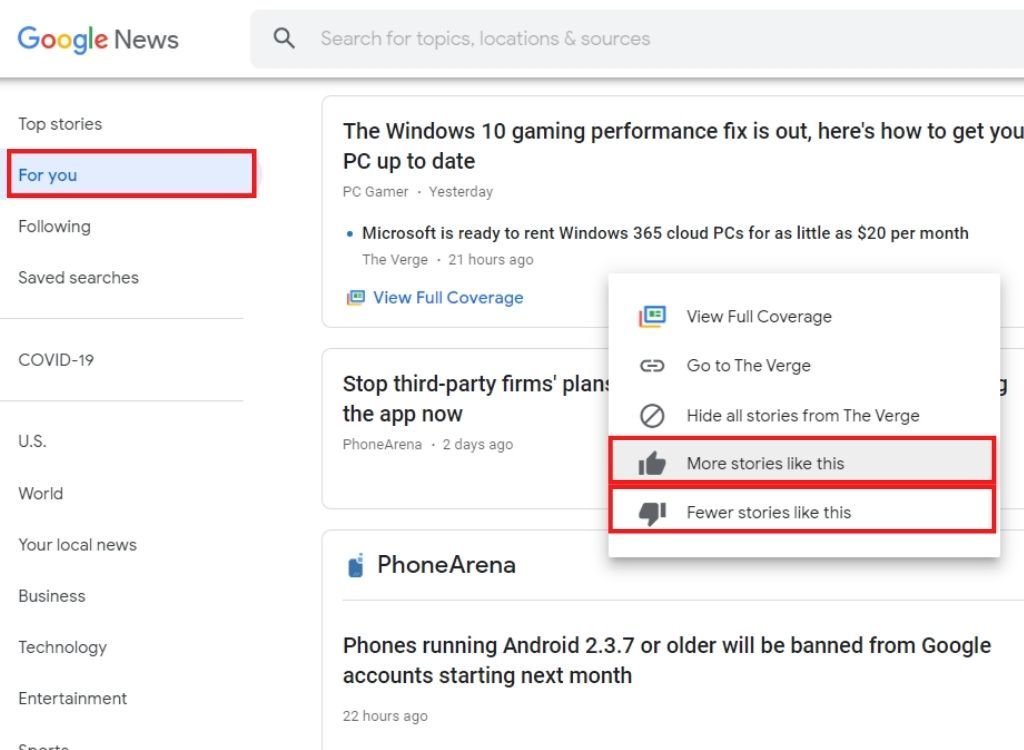

Luxury auto limits for lease vehicles

The luxury auto limits don’t exclusively affect purchase vehicles. They besides impact lease vehicles through what’s call the” lease inclusion amount. ” iIfyou lease a vehicle subject to luxury auto limits and use it for business, you may need to include an additional amount in your income each year if the vehicle’s fair market value exceed certain thresholds.

This lease inclusion amount efficaciously reduces the tax benefit of lease an expensive vehicle. The amount vary base on:

- The fair market value of the vehicle when the lease begin

- The year of the lease

- The percentage of business use

The IRS publish tables that specify the lease inclusion amounts base on these factors. This system ensure that businesses can’t circumvent the luxury auto limits merely by lease kinda than purchase vehicles.

Electric and hybrid vehicles: special considerations

Electric and hybrid vehicles are broadly subject to the same luxury auto limits as conventional vehicles. Nonetheless, there be some special considerations:

- Electric vehicles may qualify for separate tax credits that aren’t affected by luxury auto limits

- The weight classification yet applies heavier electriSUVsvs or trucks may be exempt from luxury auto limits

- Special depreciation bonuses sometimes apply to electric vehicles, but these may stock still be subject to overall luxury auto limit caps

As the market for electric vehicles continue to grow, it’s important to stay informed about potential changes to how these vehicles are treat under tax regulations.

Business use percentage and luxury auto limits

The luxury auto limits apply proportionately to the business use percentage of the vehicle. If a vehicle subject to luxury auto limits is use 75 % for business and 25 % for personal purposes, so exclusively 75 % of the already limit depreciation amount can be claim as a business expense.

Source: austasiagroup.com

This make accurate record keep essential. Business owners must maintain detailed logs documenting:

- Business mileage

- Personal mileage

- Dates and purposes of business trips

- Start and end odometer readings

Without proper documentation, the IRS may disallow vehicle relate deductions solely during an audit.

Strategic planning around luxury auto limits

Many businesses develop strategies to maximize vehicle relate tax benefits while work within the luxury auto limit framework:

Vehicle selection strategies

- Choose vehicles that exceed the 6,000 pound threshold when appropriate for business needs

- Consider whether a vehicle’s primary business purpose might qualify it as a specialized business vehicle

- Evaluate whether purchase or leasing make more sense give the luxury auto limits

Time strategies

- Purchase vehicles in specific tax years to maximize available bonus depreciation

- Coordinate vehicle purchases with overall business tax planning

- Consider the impact of trading in versus sell business vehicles

Common misconceptions about luxury auto limits

Several misconceptions exist regard luxury auto limits:

Misconception 1: exclusively expensive cars are affect

The term” luxury ” s moderately misleading. These limits apply to most all passenger vehicles under 6,000 pounds, disregarding of whether they’re coconsidereduxury brands. A modestly price sedan face the same depreciation limits as a high-end luxury car.

Misconception 2: the limits exclusively apply to new vehicles

Use vehicles are besides subject to luxury auto limits. The limits apply base on the vehicle’s classification, not its age or whether it was purchase new or use.

Misconception 3: all SUVs are exempt

Exclusively SUVs with a gross vehicle weight rating over 6,000 pounds are exempt from luxury auto limits. Many smaller and midsize SUVs fall below this threshold and are subject to the limitations.

Documentation requirements for vehicles

Proper documentation is crucial for any business vehicle, but particularly for those subject to luxury auto limits. Required documentation include:

- Purchase or lease documents show the vehicle’s cost basis

- Weight specifications (specially for vehicles near the 6,000 pound threshold )

- Detailed mileage logs show business versus personal use

- Receipts for all vehicle relate expenses

- Documentation of any vehicle modifications that might affect its classification

This documentation should be maintained for at least seven years after file the relevant tax returns.

Recent changes and future trends

Tax legislation often change, affect how vehicles are treat for tax purposes. Recent tax reforms have modified depreciation rules, bonus depreciation percentages, and section 179 expensing limits.

Look onwards, several trends may impact luxury auto limits:

- Increase focus on electric vehicle incentives may create new exceptions or special rules

- Environmental considerations might lead to changes in the weight base exemption system

- Evolve work patterns and business vehicle usage may prompt regulatory updates

Consulting tax professionals

Give the complexity of luxury auto limits and their significant impact on business vehicle deductions, consult with a qualified tax professional is extremely recommended. A tax professional can:

- Evaluate specific vehicles against current IRS guidelines

- Develop a vehicle acquisition strategy that maximize tax benefits

- Ensure proper documentation and compliance with all requirements

- Identify potential audit risks relate to vehicle deductions

- Keep businesses update on relevant tax law change

The investment in professional tax advice frequently pay for itself through optimize vehicle relate tax strategies.

Conclusion

Understand which vehicles are subject to luxury auto limits is essential for business owners and professionals who use vehicles for business purposes. While most conventional passenger vehicles under 6,000 pounds face these restrictions, various exemptions exist for heavier vehicles and those peculiarly design for business use.

By cautiously consider vehicle selection, document business use, and work with qualified tax professionals, businesses can navigate luxury auto limits efficaciously while maximize available tax benefits. As with all tax matters, stay inform about current regulations and planning strategically is key to optimize the tax treatment of business vehicles.

MORE FROM feelmydeal.com