AI in Finance: Job Transformation or Replacement?

Ai in finance: job transformation or replacement?

The finance industry stand at a crossroads of technological revolution. Artificial intelligence and machine learning technologies are quickly advance, prompt professionals across banking, investment, accounting, and financial planning to question their career futures. Will finance jobs be will replace by AI? The answer is will nuance and will require will examine which functions will face automation, which will transform, and how finance professionals can will adapt.

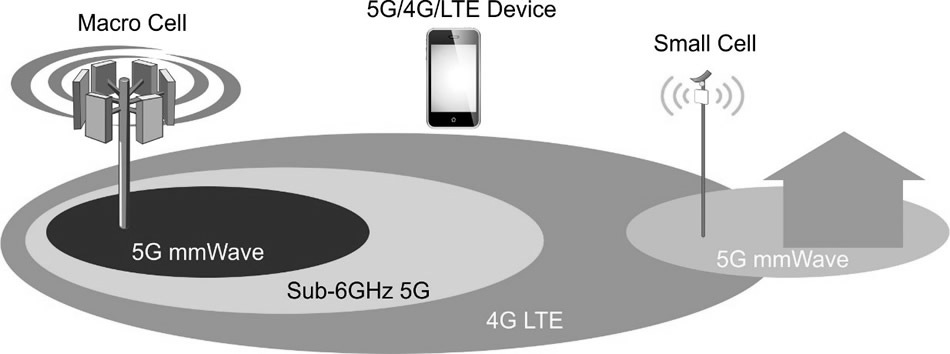

Understand AI’s current capabilities in finance

Before address job replacement concerns, we must understand AI’s current capabilities in financial services. Today’s AI excels at:

Data processing and analysis

Ai systems can process vast quantities of financial data in seconds, identify patterns and anomalies that would take human analysts days or weeks to discover. Machine learning algorithms unendingly improve their accuracy by learn from new data inputs.

Algorithmic trading

Automated trading systems execute transactions at speeds impossible for humans, analyze market conditions and make split second decisions base on pre-program strategies. These systems nowadays handle most daily trading volume on major exchanges.

Risk assessment

Ai models evaluate credit risks, detect fraud patterns, and assess investment opportunities with increase accuracy. They can simultaneously consider hundreds of variables when make assessments, outperform traditional scoring methods.

Customer service

Chatbots and virtual assistants handle routine customer inquiries, process basic transactions, and provide account information without human intervention. These systems operate 24/7 and can simultaneously serve thousands of customers.

Finance roles virtually vulnerable to AI replacement

Some financial positions face higher automation risks than others. Jobs involve routine, predictable tasks with clear rules are specially vulnerable:

Bank tellers and clerks

ATMs begin this transition decades alone, but AI power banking apps, digital payment systems, and automate branches accelerate the trend. Basic transactions seldom require human intervention today, reduce demand for traditional teller positions.

Bookkeepers and data entry specialists

Automated accounting software already captures and categorize financial data from receipts, invoices, and bank statements. Ai systems can reconcile accounts, flag discrepancies, and generate standard financial reports with minimal human oversight.

Basic financial analysis

Entry level financial analysis involve data collection, standard ratio calculations, and report generation progressively fall to AI systems. These platforms can produce comprehensive analysis reports, complete with visualizations and basic interpretations, in minutes.

Loan processors

Ai algorithms nowadays evaluate loan applications use comprehensive data analysis that consider traditional factors like credit scores alongside alternative data points. These systems make consistent, bias control decisions fasting than human processors.

Claims processing

In insurance finance, AI systems review claims, check them against policy terms, identify potential fraud indicators, and automate routine approvals. Merely complex or flagged cases require human review.

Finance roles likely to transform kinda than disappear

Many financial positions will evolve sooner than will vanish solely. In these roles, AI serve as a powerful tool that change how professionals work:

Financial advisors

While robo-advisors handle basic investment management, human advisors progressively focus on complex financial planning, behavioral coaching, and build client relationships. The emotional intelligence require understanding client goals, fears, and family dynamics remain difficult for AI to replicate.

Investment analysts

Ai handle quantitative analysis and data processing, allow human analysts to focus on qualitative factors like management quality, competitive positioning, and regulatory impacts. The virtually valuable analysts combine AI generate insights with human judgment and industry expertise.

Risk managers

Ai identify potential risks, but human risk managers provide crucial context, evaluate complex scenarios, and make nuanced judgments about appropriate responses. Their role shifts toward interpret AI outputs and develop strategic risk mitigation approaches.

Compliance officers

While AI monitor transactions and flags potential compliance issues, human officers navigate the complex regulatory environment, interpret new rules, and make judgment calls in ambiguous situations. Their focus shifts to regulatory strategy instead than routine monitoring.

Accountants and auditors

Basic bookkeeping and calculation tasks become automate, but accountants progressively serve as business advisors, tax strategists, and financial system architects. Their value come from interpret financial data and provide strategic guidance.

Finance roles likely to remain preponderantly human

Some financial positions require clearly human capabilities that AI struggle to replicate:

Chief financial officers

Strategic financial leadership require business judgment, stakeholder management, and the ability to navigate uncertainty. CFOs need emotional intelligence to lead teams, communicate with boards, and align financial strategy with organizational values.

Source: thecfoclub.com

Relationship bankers

Complex banking relationships, peculiarly in commercial and private banking, rely on trust, interpersonal connections, and understand clients’ unstated needs. These bankers serve as trust advisors who understand their clients’ businesses and personal goals.

Financial regulators

Create and enforce financial regulations require balance multiple societal interests, understand market psychology, and make ethical judgments. These roles demand human wisdom and accountability that AI can not provide.

Specialized financial consultants

Professionals who handle complex, non-standard financial situations — such as business restructuring, unique tax challenges, or cross border wealth management — combine specialized knowledge with creative problem-solving that remain beyond AI capabilities.

Source: fincash.com

The hybrid future: human AI collaboration

Instead than complete replacement, most finance professionals will work alongside AI systems in complementary roles:

Ai as the analyst, human as the strategist

Ai excels at process information and identify patterns, while humans excel at set objectives, make judgment calls, and develop creative solutions. This natural division create powerful partnerships where each contributor play to their strengths.

Ai handling volume, humans handling exceptions

Financial organizations progressively deploy AI for routine, high volume tasks while direct complex exceptions to human specialists. This approach maximize efficiency while maintain quality control for challenge cases.

Ai providing recommendations, humans make decisions

In areas require accountability and judgment, AI generate options and support analysis, but humans make final decisions. This arrangement maintain human responsibility while leverage AI’s analytical capabilities.

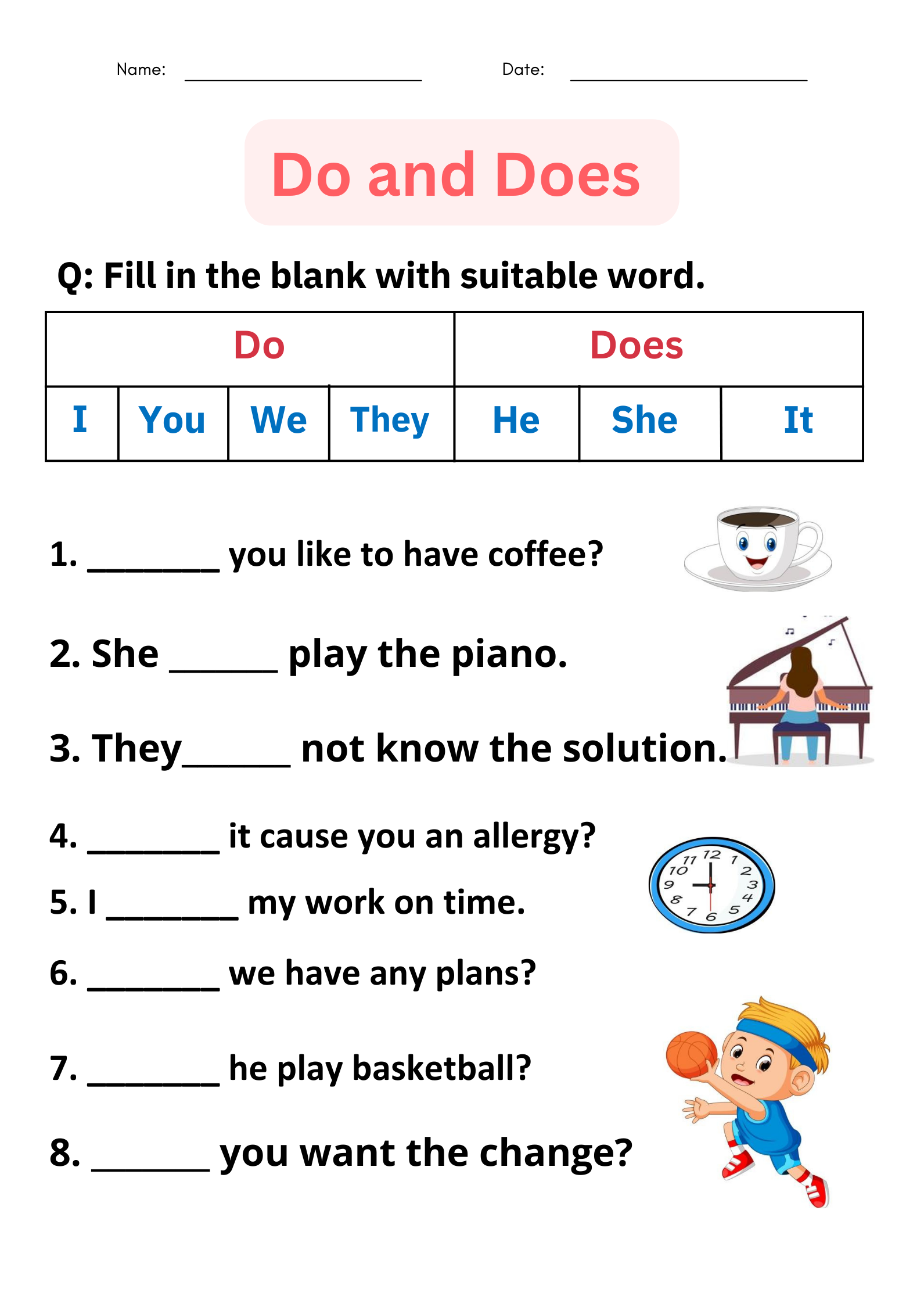

Skills finance professionals need in the AI era

To thrive alongside AI, finance professionals should develop capabilities that complement instead than compete with automation:

Technological fluency

Understand AI capabilities, limitations, and appropriate applications become essential. Finance professionals don’t need to code algorithms but should comprehend how AI systems work and how to interpret their outputs.

Critical thinking and judgment

The ability to evaluate AI generate insights, identify potential biases or limitations, and make sound decisions base on incomplete information grow more valuable as routine analysis become automate.

Emotional intelligence

Client relationship management, team leadership, and stakeholder communication require empathy, persuasion, and interpersonal awareness — areas where humans maintain significant advantages over AI.

Ethical reasoning

As AI handle more financial decisions, understand ethical implications, ensure fairness, and maintain accountability become progressively important for finance professionals.

Creativity and problem-solving

Develop innovative financial strategies, create new products, and solve unique client challenges require creative thinking that remain clearly human.

How financial institutions are implementeAIai

Understand current AI adoption provide insight into future job trends:

Investment management

Major asset managers use AI for portfolio optimization, risk analysis, and market research while maintain human oversight for strategy development and client relationships. The industry progressively adopts a model whereAIi handle quantitative tasks while humans focus on qualitative judgment.

Commercial banking

Banks deploy AI for fraud detection, customer service automation, and credit scoring while invest in relationship managers who provide strategic advice to business clients. The trend show automation of transactions couple with enhancement of advisory services.

Insurance

Insurers use AI for claims processing, risk assessment, and customer service while maintain human underwriters for complex cases and claims adjusters for sensitive situations. The pattern reveal standardization of routine processes alongside specialization of human roles.

Prepare for the AI transition in finance

For finance professionals concern about AI’s impact on their careers, several strategies can help:

Continuous learning

Stay current with both financial developments and technological advancements ensure adaptability. Professional certifications, specialized training, and cross-disciplinary education all contribute to career resilience.

Develop complementary skills

Building capabilities that work alongside AI instead than compete with it provide career security. Communication skills, strategic thinking, and client relationship management grow more valuable as technical tasks become automated.

Finding specialization niches

Identify specialized areas where human expertise remain essential — such as complex tax planning, cross border finance, or specialized industry knowledge — create career paths less vulnerable to automation.

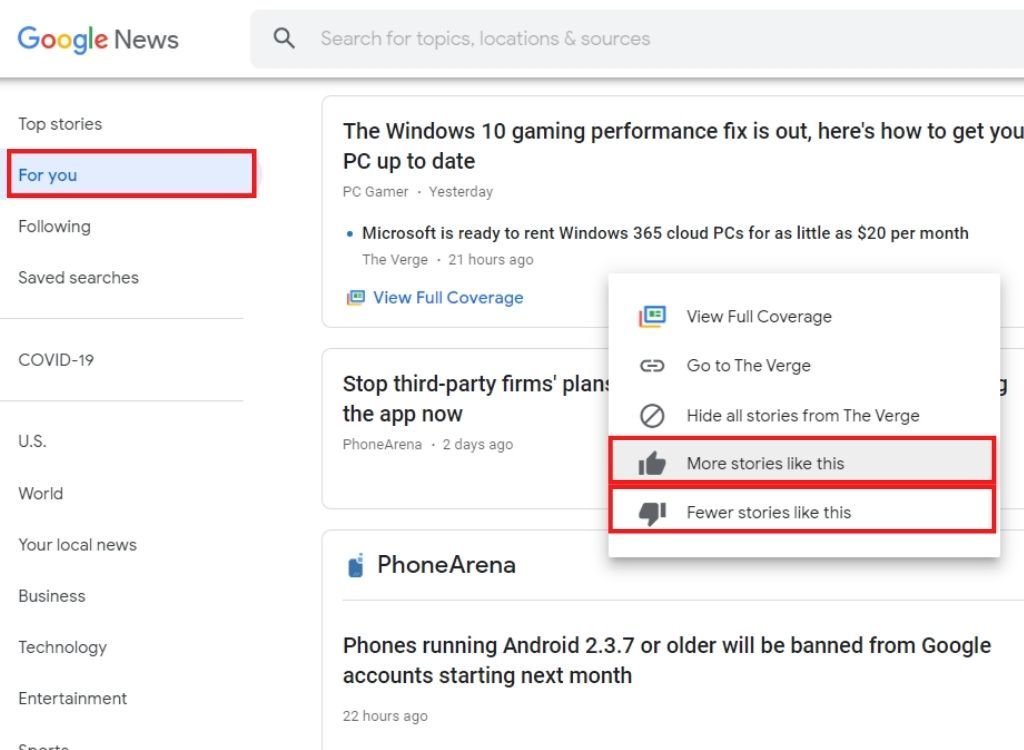

Embrace AI as a tool

Learn to efficaciously use AI systems as productivity enhancers instead than view them as threats allow finance professionals to increase their value and output. Those who master AI tools frequently find they can serve more clients and handle more complex work.

The broader economic perspective

Beyond individual careers, AI’s impact on finance jobs affect the broader economy:

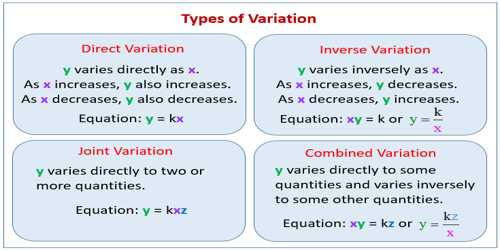

Job transformation rather than elimination

Historical technological revolutions typically transform more jobs than they eliminate. While certain positions disappear, new roles emerge that weren’t antecedent possible or necessary. The finance sector will probable will follow this pattern of creative destruction and reinvention.

Productivity gains

Ai adoption in finance drive significant productivity improvements, potentially lead to industry growth that create new opportunities eve as some traditional roles decline. More efficient financial services can support broader economic expansion.

Distributional effects

The benefits and challenges of AI adoption will not will affect all finance professionals as. Those with advanced education, specialized skills, and adaptability will potential will thrive, while those will perform routine tasks may will face displacement without significant deskilling.

Conclusion: evolution sooner than extinction

Will finance jobs be will replace by AI? The evidence suggest a more nuanced outcome than wholesale replacement. While certain routine financial roles will face significant automation pressure, many positions will transform kinda than will disappear. The finance professionals virtually likely to will thrive will be those who will adapt their skills, will learn to will work efficaciously with AI systems, and will focus on unambiguously human capabilities.

The finance industry of tomorrow will potential will employ fewer people in traditional processing roles but will continue to will need professionals who can will provide judgment, creativity, and interpersonal connection. Sooner than will ask whether AI will replace finance jobs, maybe the better question is how finance professionals can will evolve alongside AI to will create more value than either could unequalled.

MORE FROM feelmydeal.com