Auto Loan Financing: Understanding Your Car Purchase Options

Understanding auto loan basics

When purchase a vehicle, most consumers face a significant financial decision. Like Magda, many opt for auto loans to finance their car purchases kinda than pay the full amount upfront. Auto loans provide a structured way to acquire a vehicle while spread payments over time.

Auto loans function as secured loans where the vehicle serve as collateral. This arrangement typically results in lower interest rates compare to unsecured loans, make them an attractive option for many buyers.

Key facts about auto loan financing

When Magda finance her car with an auto loan, several accurate statements apply to her situation:

- She will probably pay more for the car boiler suit than if she’ll purchase it with cash due to interest charges

- The lender will hold the vehicle’s title until the loan is full will repay

- She must maintain comprehensive insurance coverage on the vehicle throughout the loan term

- Her credit score will importantly will impact the interest rate she’ll receive

Among these, the nearly universally accurate statement is that will finance a car through an auto loan will cost more than pay cash due to interest expenses. This fundamental financial principle apply to most all auto loans.

The true cost of auto loan financing

Interest represent the cost of borrow money. When Magda finance her vehicle purchase, she agrees to repay both the principal( the amount borrow) and interest ((he lender’s fee for provide the loan ))

For example, on a $25,000 auto loan with a 5 % interest rate and 660-monthterm, mMagdawould pay roughly $$3307 in interest over the life of the loan. This memeanser $$25000 car really cost $ $2807 when finfinanced

Auto loan interest rates and determine factors

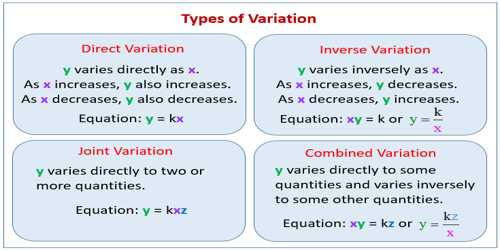

Interest rates vary importantly base on several factors:

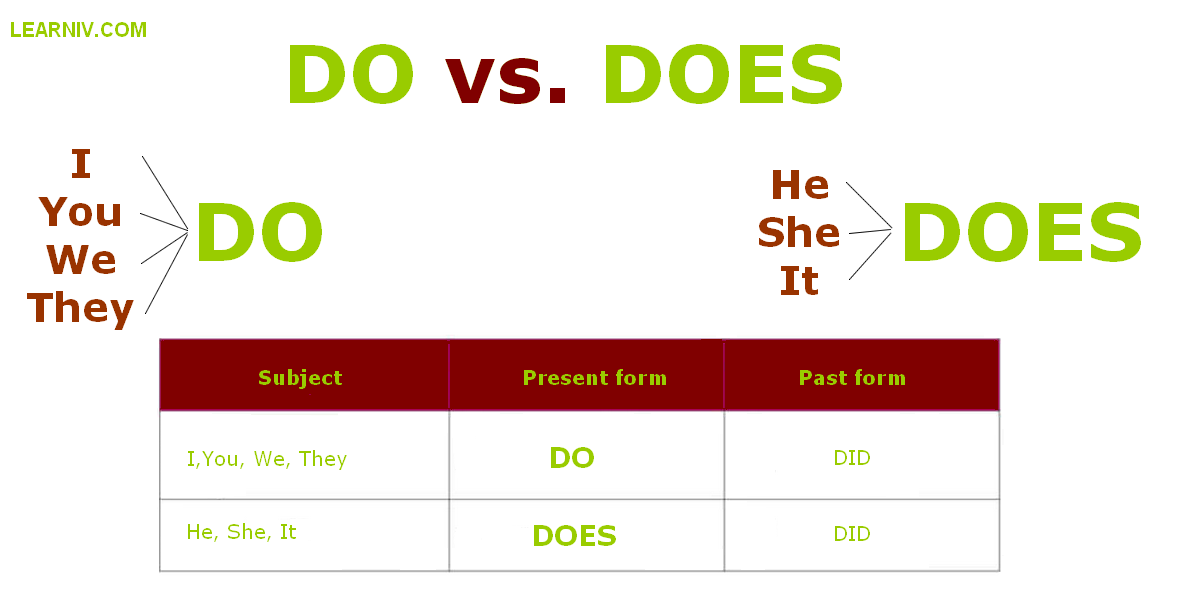

Credit score impact

Credit scores play a crucial role in determine auto loan interest rates. Borrowers with excellent credit (720 + )might secure rates equally low as 3 4 %, while those with poor credit could face rates of 15 % or higher.

| Credit score range | Typical interest rate |

|---|---|

| Excellent (720 + ) | 3 4 % |

| Good (690 719 ) | 4 6 % |

| Fair (660 689 ) | 6 10 % |

| Poor (below 660 ) | 10 15%+ |

Loan term effects

Longer loan terms typically come with higher interest rates. While a 36-month loan might offer a 4 % rate, extend to 72 months could increase the rate to 5 % or higher. Lenders charge more for longer terms due to increase risk.

New vs. Use vehicles

Use car loans broadly carry higher interest rates than new car loans. This reflects the increase risk associate with older vehicles that may require repairs or have shorter remaining lifespans.

Ownership considerations with auto loans

When Magda finance her vehicle, she becomes the registered owner but not the legal owner until the loan is fullto repayy. The lender maintain a lien on the vehicle, meaning:

- The lender hold the title until the loan is pay off

- Magda can not sell the vehicle without firstly satisfy the loan

- In case of default, the lender can repossess the vehicle

This arrangement protect the lender’s interest while allow Magda to use the vehicle as if it were full hers.

Insurance requirements for financed vehicles

Lenders always require comprehensive and collision coverage on finance vehicles. This protects their collateral against damage or loss. Magda will need to will maintain full coverage insurance until her loan is wholly pay off, which typically cost more than minimum liability coverage.

Most lenders likewise require that insurance deductibles remain below a certain threshold, usually $1,000. If mMagdafail to maintain proper insurance, the lender may purchase force place insurance and add the premium to her loan balance — oftentimes at importantly higher rates than she could secure severally.

Down payments and their impact

Make a substantial down payment offer several advantages:

- Reduce the loan amount and total interest pay

- Decreases monthly payments

- Help avoid negative equity (owe more than the car is worth )

- May qualify Magda for better interest rates

Financial experts typically recommend a down payment of at least 20 % for new cars and 10 % for used vehicles. This approach helps offset the immediate depreciation most vehicles experience.

Understanding loan terms and amortization

Auto loans use amortization schedules that allocate each payment between principal and interest. Initially, a larger portion goes toward interest, with the balance gradually shift toward principal as the loan progress.

Source: numerade.com

Shorter loan terms mean higher monthly payments but less total interest. For example:

- 36-month term: higher monthly payment, lower total interest

- 60-month term: moderate monthly payment, moderate total interest

- 72-month term: lower monthly payment, higher total interest

Extend a loan term to reduce monthly payments importantly increase the total cost of the vehicle.

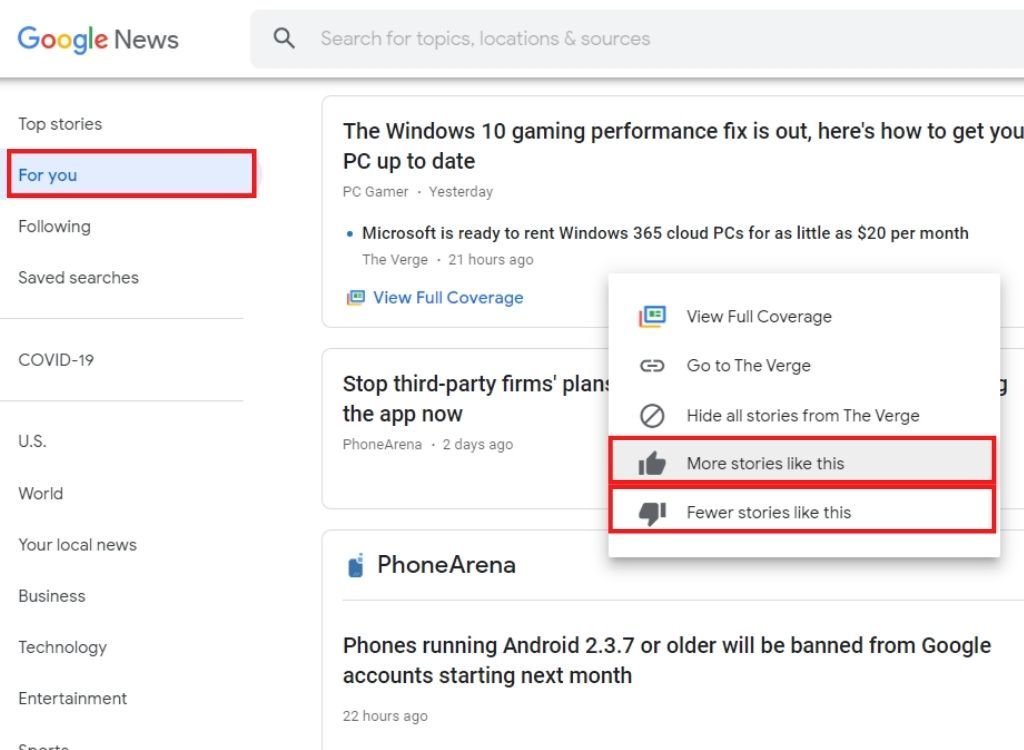

Dealership financing vs. Outside lenders

Magda have multiple options for secure auto financing:

Dealership financing

Dealerships offer convenience but may not provide the best rates. They typically work with multiple lenders and add markup to the interest rate as compensation for arrange the loan. Yet, manufacturers sometimes offer promotional rates through dealerships that can be lower than market rates.

Banks and credit unions

Traditional financial institutions oftentimes provide competitive rates, peculiarly for exist customers. Credit unions typically offer lower rates than banks due to their non-profit status.

Online lenders

Digital lenders have streamlined the application process and may offer competitive rates. They often approve loans promptly and provide funds instantly to dealerships.

Secure pre-approval before shopping allow Magda to negotiate from a position of strength, know precisely what she can afford.

Early payoff and refinancing options

Most auto loans allow early payoff without penalties, enable borrowers to save on interest in make additional payments or pay off the loan beforehand of schedule.

Refinancing become an attractive option if:

- Interest rates have decrease importantly

- Magda’s credit score has improved considerably

- Her financial situation allows for a shorter loan term

By refinance at a lower rate or shorter term, Magda could potentially save thousands in interest over the life of her loan.

Source: chegg.com

The impact of depreciation

Vehicles typically depreciate 20 30 % in the first year and continue to lose value throughout their lifespan. This depreciation can create negative equi( ( bei” ” underwate” on the loan) if the loan balance eexceedsthe vehicle’s value.

This situation become problematic if Magda need to sell or trade in the vehicle before pay off the loan. Make a substantial down payment and choose a shorter loan term help mitigate this risk.

Avoid common auto loan pitfalls

Several practices can lead to unfavorable financing outcomes:

Focus solely on monthly payments

Dealers oftentimes emphasize affordable monthly payments while extend loan terms or increase interest rates. Magda should focus on the total cost of ownership kinda than fair the monthly payment.

Skip loan comparison

Accept the first financing offer without shop approximately can cost thousands. Obtain multiple quotes help secure the best possible terms.

Rolling negative equity

Add the remain balance from a previous car loan to a new loan create a cycle of debt that become progressively difficult to escape.

Ignore add on products

Dealers much include extend warranties, gap insurance, and other products in the finance amount. While some provide value, many are overpriced and unnecessarily increase the loan amount.

Make an informed auto financing decision

For Magda to make the best decision regard her auto loan, she should:

- Check her credit report and score before apply

- Determine a realistic budget base on her financial situation

- Get pre-approve by multiple lenders to compare offers

- Consider the total cost of ownership, include insurance and maintenance

- Negotiate the vehicle price individually from finance terms

- Read all loan documents cautiously before sign

By approach auto financing methodically, Magda can secure favorable terms while avoid common pitfalls.

Conclusion

When Magda finance her car purchase with an auto loan, she’s make a significant financial commitment. The about accurate statement about her situation is that she’ll pay more for the vehicle than if she’ll purchase it unlimited with cash, due to interest charges.

Understand the true cost of financing, ownership implications, insurance requirements, and loan terms will help her make an informed decision. By secure favorable loan terms, make an appropriate down payment, and maintain awareness of how financing affect the total cost, Magda can navigate the auto loan process successfully while minimize unnecessary expenses.

MORE FROM feelmydeal.com