BPS in Finance: Understanding Basis Points and Their Critical Role in Financial Markets

What does bps stand for in finance?

Bps stand for” basis points” in finance, represent one of the well-nigh fundamental units of measurement in financial markets. A basis point equal one hundredth of a percentage point, or 0.01 %. This standardized measurement provide precision when discuss small changes in interest rates, bond yields, credit spreads, and other financial metrics.

Financial professionals worldwide rely on basis points to communicate changes with absolute clarity. Quite than say ” he interest rate increase by 0.25 %, “” ofessionals state ” ” rate rise by 25 basis points. ” thisThisminology eliminate confusion and ensure precise communication across all financial discussions.

The mathematical foundation of basis points

Understand the mathematical relationship between basis points and percentages is crucial for anyone work in finance. One basis point represent 0.01 %, which mean 100 basis points equal 1 %. This relationship create a simple conversion system:

- 1 basis point = 0.01 %

- 10 basis points = 0.10 %

- 25 basis points = 0.25 %

- 50 basis points = 0.50 %

- 100 basis points = 1.00 %

The term” basis point ” erive from the “” sis ” ” ” s” ad ” be” en two interest rates. Financial markets adopt this terminology to avoid the ambiguity that can arise when discuss percentage changes in percentages. For example, if a rate move from 5 % to 6 %, professionals describe this as a 100 basis point increase quite than a ” 20 ” ncrease, ” whic” ould confuse listeners.

Why basis points matter in financial markets

Basis points provide precision that standard percentage notation can not match in financial contexts. When deal with interest rates, bond yields, or credit spreads, small changes can have enormous economic implications. A 25 basis point change in the federal funds rate can influence millions of loans, mortgages, and investment decisions.

The precision of basis points become peculiarly important when analyze fix income securities. Bond traders regularly deal with yield changes measure in single basis points, where each basis point movement can represent thousands of dollars in profit or loss on large positions. This level of precision allow for more accurate pricing, risk assessment, and portfolio management.

Credit analysts use basis points to measure credit spreads, which represent the additional yield investors demand for take credit risk. A corporate bond might trade at 150 basis points over treasury bonds, mean investors receive 1.50 % additional yield to compensate for default risk. These measurements help investors compare risk adjust returns across different securities.

Applications across different financial sectors

Interest rates and monetary policy

Central banks worldwide communicate policy changes use basis points. The fFederal Reservetypically aadjuststhe federal funds rate in 25 basis point increments, though larger moves of 50 or 75 basis points occur during periods of economic stress. These changes ripple through the entire financial system, affect mortgage rates, credit card rates, and business lending costs.

Commercial banks use basis points to price loans relative to benchmark rates. A bank might offer a mortgage at” 200 basis points over the 110-yeartreasury rate, ” rovide a clear framework for pricing that adjust mechanically with market conditions.

Bond markets and fixed income

Bond markets rely intemperately on basis point measurements for yield comparisons and spread analysis. Government bond yields serve as benchmarks, with corporate bonds, municipal bonds, and other debt securities price at spreads measure in basis points above these benchmarks.

Duration risk, which measure a bond’s sensitivity to interest rate changes, is oftentimes express in basis points. A bond with a duration of 5 years will decrease in value by roughly 5 % for every 100 basis point increase in interest rates. This relationship help portfolio managers assess and hedge interest rate risk.

Equity markets and performance measurement

While less common than in fix income markets, basis points appear in equity analysis when discuss performance fees, expense ratios, and track error. Mutual funds and ETFs quote expense ratios in basis points, with a 50 basis point expense ratio mean investors pay 0.50 % yearly in management fees.

Hedge funds oftentimes charge performance fees calculate in basis points above benchmark returns. A fund might charge 20 % of returns exceed the S&P 500 by more than 100 basis points, create alignment between fund managers and investors.

Practical examples in real world finance

Mortgage and lending markets

Mortgage professionals use basis points every day when discuss rate changes and loan pricing. A mortgage broker might explain that rates increase by 12.5 basis points nightlong, instantly convey the impact to potential borrowers. This precision help borrowers understand precisely how market movements affect their potential monthly payments.

Commercial lending to rely on basis point pricing. A business loan might be price at ” iLIBORlus 275 basis points, “” eate a transparent pricing structure that adjust with market conditions. This approach protect lenders from interest rate risk while provide borrowers with market base pricing.

Investment management and portfolio construction

Portfolio managers use basis points to measure and communicate performance attribution. An active manager might outperform their benchmark by 75 basis points yearly, represent significant value creation for investors. This measurement allow for precise comparison between different investment strategies and managers.

Risk management teams monitor portfolio exposures use basis point measures. A fix income portfolio might have duration exposure of 450 basis points, indicate the portfolio’s sensitivity to interest rate changes. This information guide hedge decisions and risk limits.

Global variations and market conventions

While basis points represent a global standard, different markets may emphasize various applications. European markets oftentimes use basis points when discuss sovereign debt spreads, peculiarly during periods of financial stress. The spread between German bands and other European government bonds is invariably quoted in basis points.

Emerge markets frequently see basis point spread in the hundreds or thousands, reflect higher perceive risks. A Brazilian government bond might trade at 400 basis points over u.s. treasuries, indicate investors demand 4 % additional yield for currency and credit risk.

Currency markets occasionally reference basis points when discuss interest rate differentials between countries. These differentials help explain currency movements and guide carry trade strategies.

Technology and basis point calculations

Modern financial technology has make basis point calculations seamless and automatic. Trading systems, portfolio management software, and risk management platforms all incorporate basis point calculations in their core functionality. Real time data feed quote spreads and yield changes in basis points, enable instant analysis and decision-making.

Algorithmic trading systems oftentimes trigger trades base on basis point thresholds. A system might buy bonds when credit spreads widen beyond 200 basis points or sell when spreads tighten below 100 basis points. This automation requires precise basis point calculations execute at microsecond speeds.

Common misconceptions and pitfalls

Several misconceptions surround basis point usage that can lead to costly errors. The almost common mistake involve confusing basis points with percentage points. A change from 3 % to 4 % represent a 100 basis point increase, not a 1 basis point increase. This distinction become critical when large sums of money are involved.

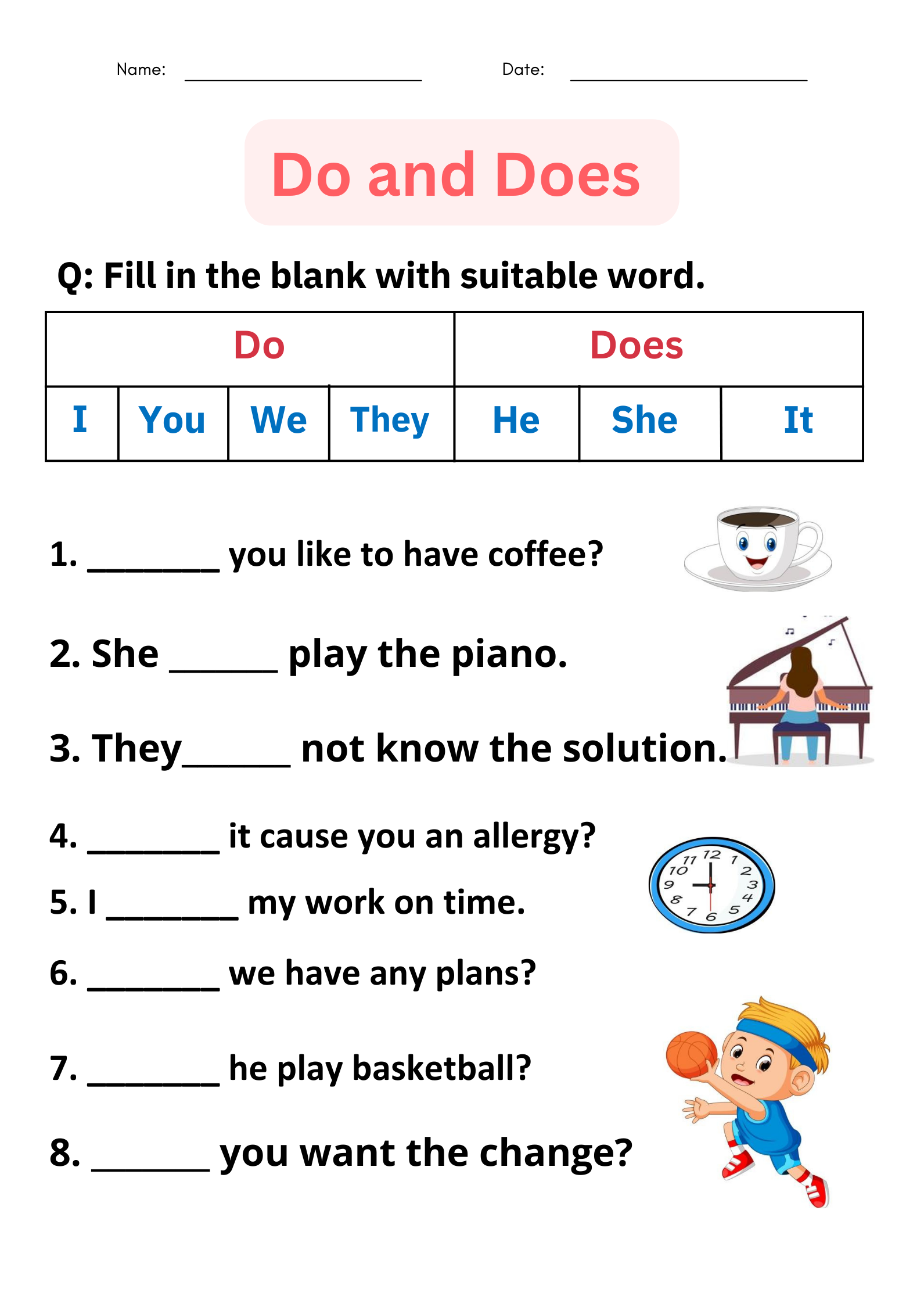

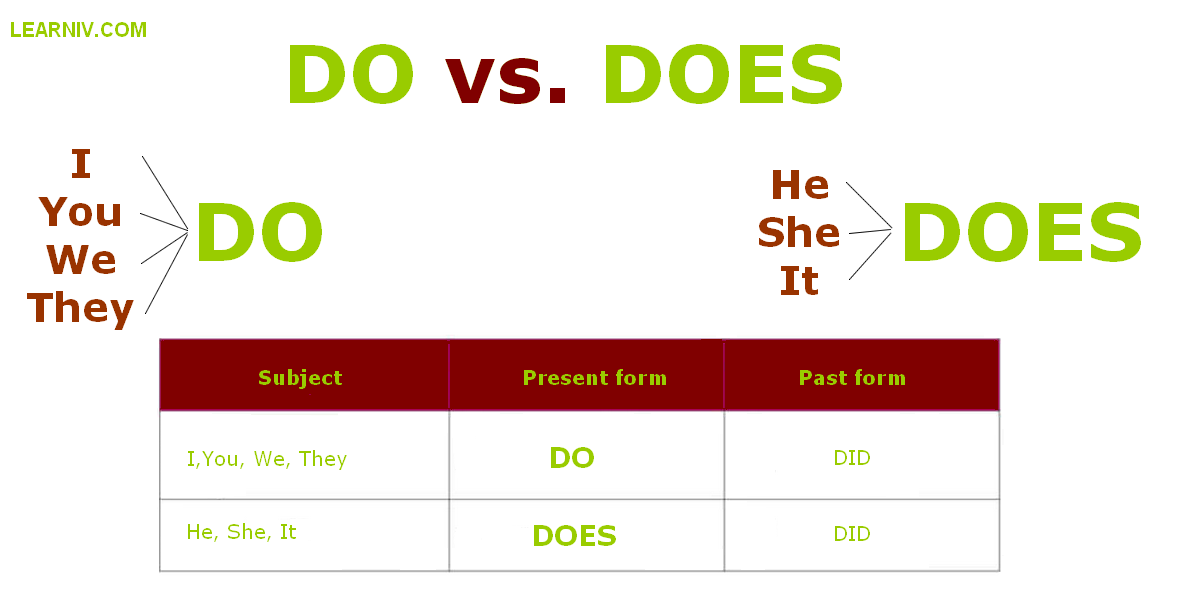

Source: madebyteachers.com

Another frequent error occur when calculate percentage changes in basis point spreads. If a credit spread widens from 100 basis points to 150 basis points, the spread increase by 50 basis points, represent a 50 % increase in the spread. The basis point change and percentage change measure different aspects of the movement.

Round errors can besides create problems in basis point calculations, peculiarly when deal with complex derivatives or structured products. Financial professionals must maintain precision throughout their calculations to avoid compound small errors into significant mistakes.

Future trends and evolving applications

The financial industry continue to find new applications for basis point measurements as markets evolve and new products emerge. Environmental, social, and governance (eESG)investing has inintroducedreen bond spreads measure in basis points, reflect the premium or discount investors place on sustainable investments.

Cryptocurrency markets are begun to adopt basis point terminology as institutional investors enter the space. Defibrillator protocols quote lend and borrowing rates in basis points, bring traditional financial precision to decentralized finance.

Central bank digital currencies (cCBDs))ay introduce new applications for basis point measurements as governments explore programmable money with variable interest rates. These innovations will probably will expand the importance of precise financial measurement tools.

Mastering basis points for financial success

Understand basis points is essential for anyone serious about finance, whether as a career or personal investment management. This precise measurement system enables clear communication, accurate analysis, and informdecision-makingg across all financial markets.

The ability to cursorily convert between basis points and percentages, understand their applications across different asset classes, and recognize their importance in risk management distinguish sophisticated financial professionals from casual observers. As financial markets will continue to will evolve and become more complex, the fundamental importance of basis points will merely grow.

Source: madebyteachers.com

Success in finance require mastery of its language, and basis points represent one of the virtually important vocabulary elements in that language. Whether analyze bond yields, compare mortgage rates, or evaluate investment performance, basis points provide the precision and clarity necessary for professional financial analysis.

MORE FROM feelmydeal.com