Breaking Into Finance Without a Finance Degree: Alternative Pathways to Success

Break into finance without a finance degree

The finance industry remain one of the virtually lucrative and dynamic career paths available, with roles span from investment banking to financial analysis, wealth management, and beyond. A common misconception is that you need a specialized finance degree to break into this field. The reality is far more flexible, with multiple entry points for professionals from diverse educational backgrounds.

While a finance degree can provide a solid foundation, it’s surely not the only path to success in this industry. Many finance professionals begin their careers with degrees in mathematics, economics, business, computer science, or evening altogether unrelated fields like liberal arts or engineering.

Why you can succeed in finance without a finance degree

Finance is finally about understand numbers, analyze data, manage risk, and make strategic decisions. These fundamental skills can be developed through various educational and professional experiences. Here’s why non finance graduates can thrive in this industry:

Transferable skills are extremely value

Many skills from other disciplines translate exceptionally advantageously to finance:

- Analytical thinking From stem backgrounds

- Communication skill From humanities degrees

- Problem solve abilities From engineering

- Research capabilities From scientific fields

- Project management From various professional experiences

Diverse perspectives are progressively sought after

Financial institutions progressively recognize the value of diverse thinking. Someone with a psychology background might excel at understand client behavior in wealth management, while a computer science graduate might revolutionize algorithmic trading strategies.

The industry is evolved quickly

With fintech disruption, regulatory changes, and global market shifts, finance is evolvedfirmer thann traditional education can sometimes keep pace with. Thcreatesate opportunities for those who can demonstrate relevant skills disregarding of their academic background.

Strategic pathways into finance for non finance graduates

Leverage adjacent degrees

Some degrees course align with finance careers:

- Economics provides strong theoretical understanding of markets and economic principles

- Mathematics / statistics excellent foundation for quantitative finance roles

- Computer science progressively valuable for fintech, algorithmic trading, and data analysis

- Business administration offer broad business acumen applicable to many finance roles

- Accounting provides detailed understanding of financial statements and report

Pursue relevant certifications

Professional certifications can bridge knowledge gaps and signal commitment to employers:

Source: perfectionhangover.com

- Chartered financial analyst (cCFA) extremely respected designation for investment professionals

- Financial risk manager (fFRM) focus on risk management

- Certified financial planner (cCFP) ideal for those interested in financial planning

- Series 7 and 63 licenses require for many securities professionals

- Bloomberg market concepts demonstrate familiarity with financial markets and bBloombergterminals

These certifications require significant commitment but can considerably enhance your credibility when transition into finance.

Source: perfectionhangover.com

Develop technical skills

Modern finance rely intemperately on technology and data analysis:

- Excel mastery advanced functions, financial modeling, and vVBA

- Programming languages python, r, sSQLfor data analysis

- Financial modeling build dDCFmodels, valuation techniques

- Data visualization tableau, power bi

- Bloomberg terminal familiarity with industry standard tools

Target entry points strategically

Consider these entry paths that may be more accessible without a finance degree:

Operations and back office roles

These positions frequently focus more on process efficiency, attention to detail, and problem solve than deep financial knowledge. They provide valuable exposure to financial products and processes while allow you to learn the industry from the inside.

Client services and relationship management

If you have strong interpersonal skills, client face roles can be an excellent entry point. These positions value communication abilities and relationship building, with technical knowledge oftentimes develop on the job.

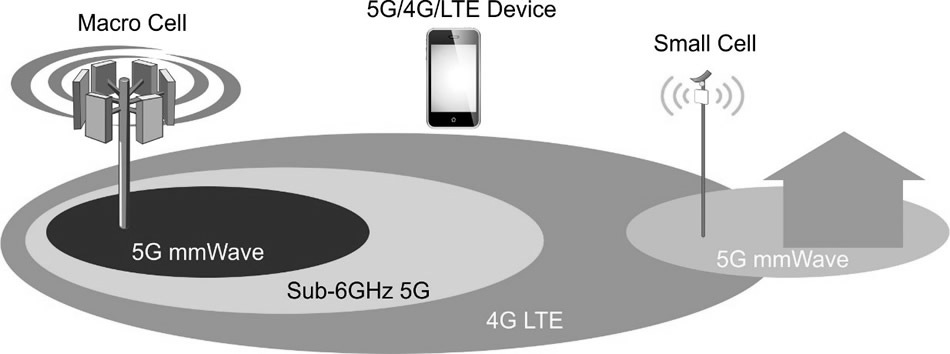

Financial technology (fintech )

They quickly grow fintech sector frequently value innovation, technical skills, and fresh perspectives over traditional finance backgrounds. This can be especially suitable for those with technology, design, or entrepreneurial backgrounds.

Sales positions

Financial sales roles frequently prioritize communication skills, persistence, and relationship building. Many successful financial advisors and institutional sales professionals start without finance degrees.

Compliance and regulatory roles

Those with legal backgrounds or strong attention to detail may find opportunities in compliance departments, where understand regulations and implement controls is more important than deep financial expertise.

Practical steps to break into finance

Build a finance focused resume

Yet without a finance degree, you can create a resume that appeal to financial employers:

- Highlight quantitative achievements from any role

- Emphasize analytical projects and data drive decision make

- Showcase relevant coursework or self study in finance topics

- Include any exposure to financial concepts, yet in non finance roles

- List technical skills relevant to finance (excel, sSQL etc. )

Network strategically

Networking is peculiarly important when transition into finance without traditional credentials:

- Join finance focus professional organizations

- Attend industry conferences and events

- Connect with alumni from your school work in finance

- Participate in online communities like Wall Street oasis or LinkedIn groups

- Consider informational interviews with professionals in your target role

Develop financial literacy

Immerse yourself in financial knowledge through:

- Read financial news (wWall Streetjournal, fFinancial Times bBloomberg)

- Follow market trends and understand basic economic indicators

- Take online courses through platforms like Coursera, EDX, or Wall Street prep

- Read foundational finance books and textbooks

- Listen to finance podcasts and follow industry thought leaders

Consider graduate education

While not invariably necessary, these programs can facilitate career transitions:

- Master’s in finance provide specialized knowledge in a concentrated timeframe

- MBA with finance concentration offer broader business knowledge with finance focus

- Master’s in financial engineering for quantitative roles ((equire strong math background ))

- Part-time or online programs allow you to gain credentials while work

Create learning projects

Demonstrate your finance capabilities through self direct projects:

- Build a stock portfolio (real or simulated )and document your investment thesis

- Conduct and publish company valuations or industry analyses

- Develop financial models and share them on platforms like GitHub

- Participate in financial modeling competitions

- Write finance focus articles on LinkedIn or medium

Success stories: finance professionals without finance degrees

Many successful finance professionals start in other fields:

- Engineers who transition to quantitative trading

- Liberal arts graduates who excel in client face wealth management

- Computer science majors who revolutionize algorithmic trading

- Psychology graduates who apply behavioral finance concepts to investment strategy

- Teachers who leverage communication skills to become financial advisors

The common thread among these success stories is persistence, continuous learning, and the ability to translate exist skills into financial contexts.

Finance sectors near accessible to career changers

Some areas of finance are more receptive to non-traditional backgrounds:

Financial planning and wealth management

These client focus roles value relationship building and communication skills. Many successful advisors come from teaching, sales, or other people orient professions.

Financial technology (fintech )

This chop chop evolve sector oftentimes value innovation and technical skills over traditional finance backgrounds. Software developers, UX designers, and product managers can find opportunities here.

Corporate finance

Internal finance departments in non-financial companies may be more flexible about educational backgrounds, specially for those already work within the organization.

Risk management

This field value analytical thinking and attention to detail. Those with backgrounds in mathematics, statistics, or level disciplines like engineering can transition efficaciously.

ESG and impact investing

This grows area oftentimes valuesubjectr expertise in environmental science, social policy, or governance alongside financial acumen.

Overcome common challenges

Address knowledge gaps

Be proactive about identify and address areas where your knowledge may be lack:

- Create a structured self study plan focus on core concepts

- Take targeted courses to address specific weaknesses

- Find a mentor who can guide your learning journey

- Join study groups or communities of other career changers

Handle interview questions about your background

Prepare to address the” why finance without a finance degree ” uestion:

- Frame your non-traditional background as a unique strength

- Emphasize transferable skills and how they apply to the specific role

- Demonstrate your commitment through self study and certifications

- Provide examples of how you’ve already apply financial concepts

Navigate recruitment processes

Many finance firms have structure recruitment processes design for traditional candidates:

- Research alternative entry programs at target companies

- Consider smaller firms that may have more flexible hiring criteria

- Use network to secure interviews outside standard recruitment cycles

- Prepare exhaustively for technical questions to overcome skepticism

Long term career development in finance

Once you’ve secured your initial finance role, focus on:

- Continuous learning stay current with industry trends and regulations

- Specialization develop deep expertise in a specific area

- Relationship building expand your professional network within the industry

- Professional development pursue advanced certifications and training

- Performance metrics achieve measurable results that demonstrate your value

Conclusion: your finance career is possible

Break into finance without a finance degree require determination, strategic planning, and a willingness to invest in your own development. Nonetheless, the diverse perspectives and transferable skills you bring from other fields can finally become your greatest assets in a financial career.

The finance industry continues to evolve, create new opportunities for professionals withnon-traditionall backgrounds. By focus on build relevant skills, obtain key certifications, leverage your unique strengths, and network efficaciously, you can successfully transition into this rewarding field.

Remember that many of today’s finance leaders did not start with finance degrees. What finally matter is your ability to create value, solve problems, and continue to grow throughout your career.

MORE FROM feelmydeal.com