Business Expense Deductions: Understanding Meal and Entertainment Allowances

Business expense deductions: understand meal and entertainment allowances

Business expenses represent a significant opportunity for tax savings for business owners and self employ individuals. Notwithstanding, not all business expenses are treat as when it comes to tax deductions. Meals and entertainment expenses, in particular, have specific rules that limit how much can be deducted. Understand these limitations is crucial for accurate tax planning and compliance.

Source: lilliswsela.pages.dev

The basics of business expense deductions

Before dive into the specifics of meal and entertainment deductions, it’s important to understand the general principle behind business expense deductions. The internal revenue service (iIRS)allow businesses to deduct ordinary and necessary expenses incur in carry out their trade or business. These deductions reduce taxable income, thereby lower the overall tax burden.

For an expense to be deductible, it must be:

- Ordinary and necessary for your business

- Direct relate to your business

- Reasonable in amount

- Decently document

Changes to meal and entertainment deductions

The tax laws regard meal and entertainment expenses have undergone significant changes in recent years. The tax cuts and jobs ac((TCAa) considerably modify the rules for deduct these expenses. Understand these changes is essential for proper tax planning.

Entertainment expenses

One of the virtually significant changes was the elimination of deductions for entertainment expenses. Antecedent, businesses could deduct 50 % of qualify entertainment expenses. Notwithstanding, under current tax law, entertainment expenses are loosely no retentive deductible.

Entertainment expenses typically include:

- Tickets to sport events

- Theater or concert tickets

- Golf club memberships

- Hunting, fishing, or vacation trips

- Tickets to nightclubs

This mean that businesses can not yearn deduct expenses for entertain clients, prospects, or other business contacts at sporting events, theaters, clubs, or similar venues.

Business meal expenses

While entertainment deductions were eliminated, business meal deductions werepreservede, albeit with some modifications. Under standard rules, businesses can typically deduct 50 % of qualifying business meal expenses.

Notwithstanding, temporary provisions have been implemented that allow for enhanced deductions for business meals under certain circumstances. These temporary provisions were design to support the restaurant industry during challenge economic times.

Temporary 100 % deduction for business meals

A notable temporary provision allow for a 100 % deduction for business meals provide by restaurants. This provision apply to food and beverages purchase from restaurants for business purposes.

For this enhanced deduction to apply, the meals must:

- Be provide by a restaurant

- Be ordinary and necessary business expenses

- Not be lavish or extravagant

- Have the taxpayer (or an employee )present when the food or beverages are fufurnished

- Be provide to a current or potential business customer, client, consultant, or similar business contact

It’s important to note that this temporary provision have specific time limitations, and businesses should consult current IRS guidelines or a tax professional for the nightup-to-datee information.

Analyzing Arthur’s business expense deduction

Nowadays, let’s apply these rules to Arthur’s specific situation. Arthur has the following business expenses for the tax year:

- Entertainment: $2,330

- Meals: $1,448 ((rovide by a restaurant ))

Entertainment expense analysis

Under current tax law, entertainment expenses are loosely not deductible. Hence, Arthur can not deduct the $2,330 spend on entertainment expenses.

Meal expense analysis

For the meals provide by a restaurant, Arthur may be eligible for a 100 % deduction under the temporary provision, assume all other requirements are meet. This mean Arthur could potentially deduct the full $1,448 spend on meals provide by restaurants.

Calculating Arthur’s total allowable deduction

Base on the information provide and current tax regulations:

- Entertainment expenses: $0 ((ot deductible ))

- Meal expenses: $1,448 ((00 % deductible as they were prprovidedy a restaurant )

Hence, Arthur’s total allowable business expense deduction for the tax year is $1,448.

Documentation requirements for meal and entertainment expenses

Proper documentation is crucial for support deductions for business meals. The IRS require taxpayers to maintain adequate records to substantiate their deductions. For business meals, this documentation should include:

- The amount spend on each meal

- The date the meal occur

- The name and location of the restaurant

- The business purpose of the meal

- The business relationship of the people at the meal (such as names, titles, or other information establish their business relationship to you )

Maintain detailed records is essential in case of an IRS audit. Credit card statements solely are broadly not sufficient documentation.

Common misconceptions about meal and entertainment deductions

There be several common misconceptions about meal and entertainment deductions that can lead to errors on tax returns:

Misconception 1: all business meals are 100 % deductible

While certain business meals may qualify for a 100 % deduction under temporary provisions, the standard deduction for business meals is loosely 50 %. It’s important to understand which meals qualify for enhanced deductions and which are subject to the standard limitation.

Misconception 2: entertainment is notwithstanding deductible if business is discussed

Yet if business is discussed during an entertainment activity, the cost of the entertainment itself is loosely not deductible under current tax law. Notwithstanding, meals consume during entertainment events may be deductible if they’re individually state on the invoice.

Misconception 3: all meal expenses qualify as business expenses

For a meal expense to be deductible, it must have a clear business purpose and not be lavish or extravagant. Personal meals are not deductible, yet if your travel for business. Exclusively meals with clients, prospects, or business associates where business is didiscussedualify as business meal expenses.

Strategies for maximizing business meal deductions

While entertainment expenses are loosely no foresight deductible, there be strategies businesses can use to maximize their meal deductions:

Strategy 1: separate meal and entertainment expenses

When attend events that include both meals and entertainment, ask for separate bills or ensure that the meal portion is individually state on the invoice. This may allow you to deduct the meal portion eventide though the entertainment portion is not deductible.

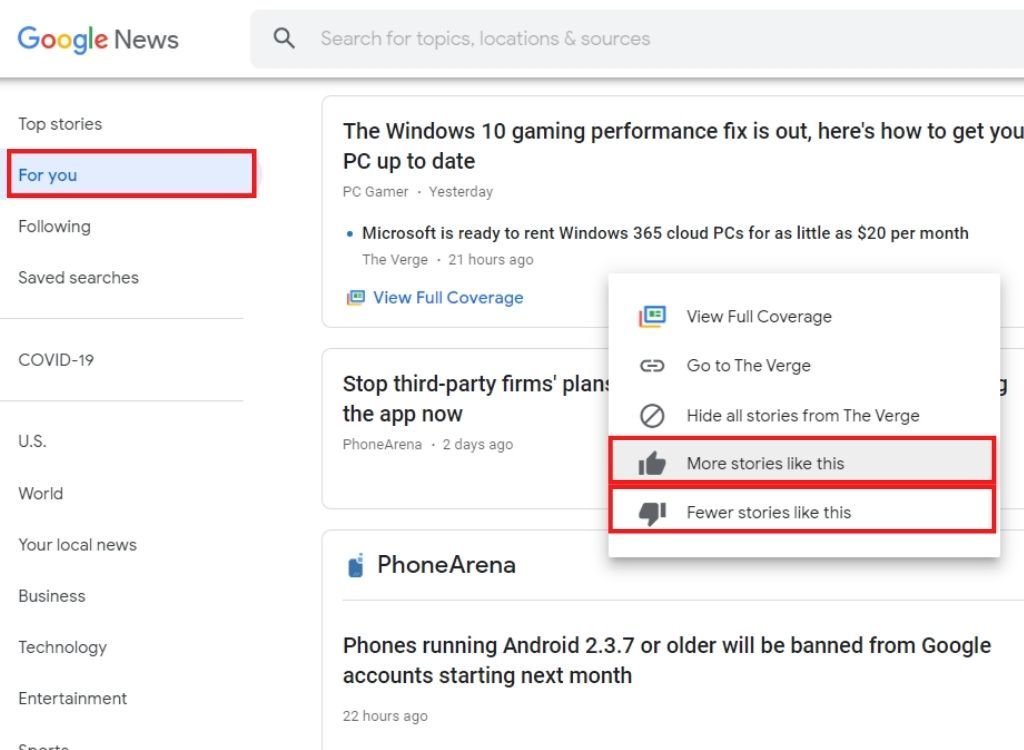

Source: newpath1010.org

Strategy 2: host business meals alternatively of entertainment events

Consider shift your client relationship building activities from entertainment events to business meals at restaurants. While you can no retentive deduct the cost of take clients to sport events or theaters, you can notwithstanding deduct the cost of business meals where business is discussed.

Strategy 3: take advantage of temporary provisions

Be aware of any temporary provisions that may allow for enhanced deductions for certain types of business meals. Consult with a tax professional to ensure you’re taken advantage of all available deductions.

Seek professional tax advice

Tax laws regard business expense deductions can be complex and subject to change. What’s allowable as a deduction can vary base on specific circumstances, the nature of your business, and current tax regulations.

For this reason, it’s advisable to consult with a qualified tax professional who can provide guidance tailor to your specific situation. A tax professional can help ensure your claim all the deductions you’re enentitledo while remain compliant with tax laws.

Conclusion

Understand the rules for business expense deductions, specially for meals and entertainment, is essential for effective tax planning. While entertainment expenses are loosely no retentive deductible, business meals can notwithstanding provide valuable tax savings.

In Arthur’s case, his allowable business expense deduction for the tax year is $1,448, represent the cost of meals provide by restaurants. The entertainment expenses of $$2330 are not deductible under current tax law.

By stay inform about tax regulations and maintain proper documentation, business owners can maximize their legitimate deductions while avoid potential issues with the IRS. Remember that tax laws can change, so it’s important to stay update on current regulations or consult with a tax professional for the nigh accurate advice.

MORE FROM feelmydeal.com