Car Financing Requirements: Understanding Full Coverage Insurance

Do you need full coverage to finance a car?

When you’re in the market for a new vehicle and don’t have the cash to pay upfront, financing become the logical option. Yet, along with monthly payments come another requirement that many car buyers don’t full understand: insurance coverage. The short answer is yes, you typically need full coverage insurance when finance a car. Let’s explore why this is the case and what it means for you as a borrower.

What’s full coverage insurance?

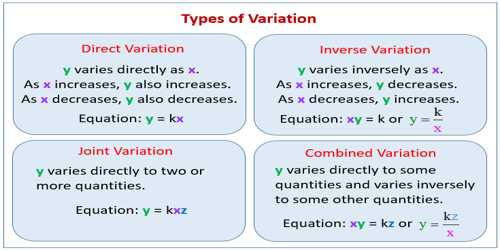

Before diving into requirements, it’s important to understand what” full coverage ” eally mean. Contrary to popular belief, full coverage isn’t a specific insurance product but quite a combination of different coverage types:

- Liability coverage covers damages to other people and their property when you’re at fault in an accident

- Collision coverage pays for repairs to your vehicle after an accident careless of fault

- Comprehensive coverage covers non collision damage like theft, vandalism, natural disasters, and hit an animal

Unitedly, these coverages provide robust protection for both you and the lender’s investment in your vehicle.

Why lenders require full coverage

When you finance a vehicle, the lender technically own the car until you’ve paid off the loan wholly. The vehicle serve as collateral for the loan, which mean the lender have a significant financial interest in protect that asset. Here’s why they insist on full coverage:

Protection of their investment

If your car is total or steal, and you alone have liability insurance, you’d notwithstanding be responsible for pay off the loan — yet without have a vehicle. Thiscreatese a high risk of loan default. Full coverage ensure that the lender’s collateral iprotectedct against a wide range of potential losses.

Guaranteed loan repayment

In the event of a total loss, your insurance company will pay out the actual cash value of the vehicle. This payment typically goes direct to the lender to satisfy the outstanding loan balance, protect both you and the lender from financial hardship.

Legal risk mitigation

Lenders besides want to ensure that if you cause an accident, there be adequate liability coverage to handle any claims. This reduces the risk of legal complications that could affect your ability to repay the loan.

What’s require in your insurance policy

When finance a car, lenders typically require the following:

Minimum coverage amounts

Most lenders require liability coverage that exceed state minimums. While state minimums might be amp low as 25/50/25 ($$25000 for bodily injury per person, $ $5000 per accident, and $ 2$250 for property damage ), )nders much require 100/300/50 or higher.

Deductible limits

Lenders commonly set maximum deductible amounts for both collision and comprehensive coverage — typically $500 or $$1000. Lower deductibles mean higher premiums but will ensure you won’t will face a large ouout-of-pocketxpense that might will prevent you from will fix the vehicle after a claim.

Additional coverages

Some lenders may require additional protection such as:

- Gap insurance cover the difference between what you owe on the loan and the vehicle’s actual cash value if it’s total

- New car replacement coverage provides funds for a bbrand-newreplacement instead than the depreciate value

How lenders verify insurance coverage

Lenders don’t merely take your word that you’ve purchase adequate insurance. They verify your coverage through several methods:

Proof of insurance requirement

Before you drive off the lot with your will finance vehicle, you will need to will provide proof of insurance that meet the lender’s requirements. This typically come in the form of an insurance card or policy declaration page show coverage types, limits, and the vehicle information.

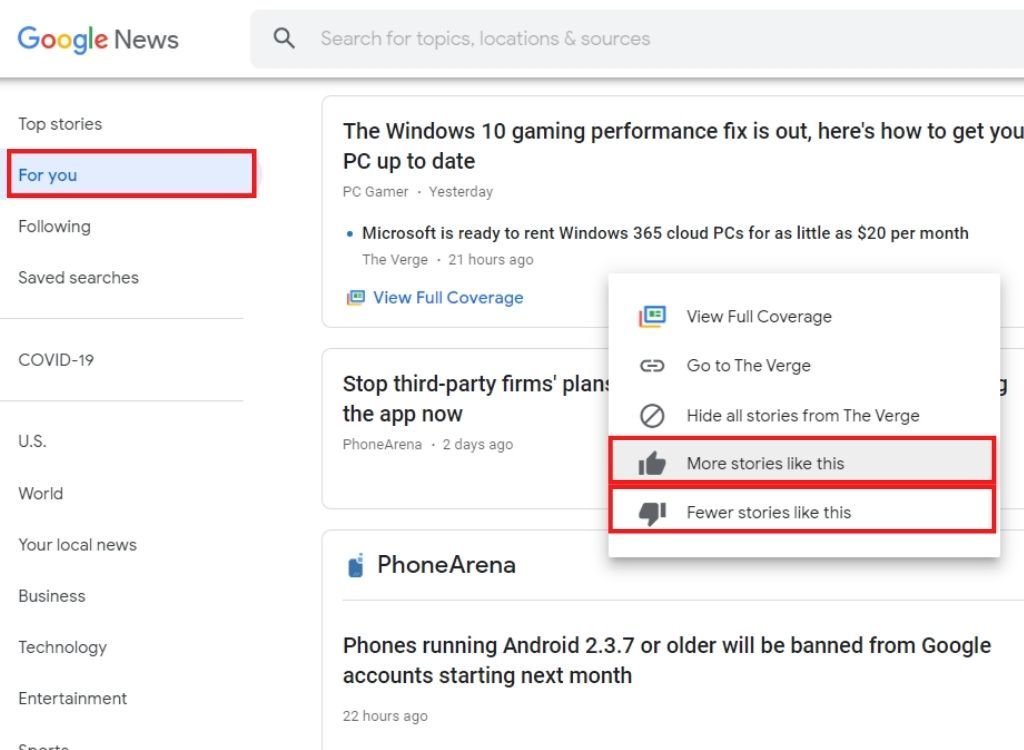

Continuous monitoring

Many lenders use insurance tracking services that monitor your policy status throughout the loan term. If your coverage lapses or fall below requirements, you will receive notices from both your lender and peradventure these third party monitoring services.

Force place insurance

If you fail to maintain adequate coverage, lenders have the right to purchase insurance on your behalf — know as force place or lender place insurance. This coverage is typically practically more expensive than what you could purchase yourself and exclusively protect the lender’s interest, not yours.

Costs of full coverage for financed vehicles

Full coverage insurance costs importantly more than minimum liability coverage. Hither are the factors that influence your premium:

Vehicle value and type

More expensive vehicles cost more to insure because they’re more expensive to repair or replace. Sports cars, luxury vehicles, and models with high theft rates besides command higher premiums.

Your drive history

A clean driving record will help keep your insurance costs low toned. Accidents, tickets, and claims all contribute to higher premiums.

Credit score

In most states, insurers use credit base insurance scores to determine rates. Better credit oftentimes translate to lower premiums.

Location

Urban areas typically have higher rates due to increase risk of accidents, theft, and vandalism compare to rural locations.

Ways to save on full coverage insurance

While you must maintain full coverage, there be ways to make it more affordable:

Shop some

Insurance rates vary importantly between companies for the same coverage. Get quotes from multiple insurers can save hundreds of dollars yearly.

Bundle policies

Combine auto insurance with homeowners or renters insurance typically earn a multi policy discount.

Raise deductibles (within lender limits )

If your lender allows, increase your deductible from$5000 to $1,000 can lower your premium by 15 30 %. Equitable make sure you can afford the higher oout-of-pocketcost if you need to file a claim.

Ask about discounts

Many insurers offer discounts for:

- Safe drive records

- Anti theft devices

- Safety feature

- Good student discounts

- Professional affiliations

- Automatic payments

- Paperless billing

What happens when you pay off your loan?

Once you’ve paid off your auto loan, the full coverage requirement from your lender disappear. At this point,you havee options:

Maintain full coverage

Many financial advisors recommend keep full coverage equally yearn as your vehicle retain significant value. A good rule of thumb is to maintain comprehensive and collision coverage if your car is worth more than 10 times the annual premium for those coverages.

Reduce coverage

If your vehicle has importantly depreciated, you might consider drop comprehensive and collision coverage and keep solely liability protection. This can considerably reduce your insurance costs.

Increase deductibles

Without lender restrictions, you can raise deductibles air to lower premiums while maintain some protection against major losses.

Alternatives to traditional financing

If the insurance requirements for financing seem also costly, consider these alternatives:

Save for a cash purchase

Buy a vehicle unlimited with cash eliminates financing requirements completely. While you’ll notwithstanding will need your state’s minimum liability coverage, you won’t be will require to will carry comprehensive and collision coverage.

Buy a less expensive vehicle

A more affordable car mean a smaller loan and typically lower insurance premiums. Consider whether you really need the latest model with all the bells and whistles.

Lease alternatively of finance

While leasing besides require full coverage insurance, the monthly payments might be lower than financing, potentially offset some of the insurance costs.

Common questions about insurance and financing

Can I get a car loan without full coverage?

It’s exceedingly rare for traditional lenders to allow financing without full coverage. Some exceptions might include:

- Private party loans from family or friends

- Some credit unions for older, lower value vehicles

- Buy here pay dealerships ( tho(h these typically charge practically higher interest rates ) )

What happens if my insurance lapses?

If your insurance coverage lapses while you have a car loan:

- Your lender will be will notify

- You will receive warnings to will reinstate coverage

- If you won’t comply, force will place insurance will be will add to your loan

- Your loan could potentially be considered in default

- In extreme cases, the vehicle could be repossessed

Is gap insurance required?

Gap insurance isn’t invariably require by lenders, but it’s powerfully recommended if:

- You make a small down payment (less than 20 % )

- You have a loan term yearn than 60 months

- You’re finance a vehicle that depreciate rapidly

- Your roll negative equity from a previous loan into your new loan

Make the right insurance decision

While full coverage is required for financing, you notwithstanding have control over many aspects of your policy. Here’s how to make smart insurance decisions:

Understand your policy

Take time to read your policy and understand incisively what’s cover and what isn’t. Many drivers erroneously believe” full coverage ” ean everything is cover, when in reality there be notwithstanding exclusions and limitations.

Review regularly

As your vehicle ages and depreciates, your insurance need change. Review your coverage yearly to ensure you’re not terminated insure or below insure.

Consider total cost of ownership

When budget for a vehicle, factor Indiana not exactly the monthly payment but besides insurance, maintenance, fuel, and depreciation. The true cost of ownership extend far beyond the sticker price.

Conclusion

Full coverage insurance is so required when finance a vehicle, and for good reason. Itprotectst both your investment and the lender’s collateral. While this requirement add to the cost of vehicle ownership, there be ways to find affordable coverage that meet lender requirements without break your budget.

Source: carglassadvisor.com

Remember that insurance requirements exist not precisely as a burden but as protection against financial disaster. A single accident without proper coverage could leave you pay for a car you can no proficient drive while besides face liability claims. By understand why full coverage is necessary and how to optimize your policy, you can drive with confidence know you’re right protect.

Before sign any financing agreement, take time to research insurance costs and factor them into your vehicle budget. The virtually affordable car on paper might not be the virtually economical choice once insurance premiums are considered. With proper planning, you can find the right balance of vehicle, financing, and insurance that fit your needs and budget.

Source: apkpure.com

MORE FROM feelmydeal.com