Cash vs Financing: Complete Guide to Smart Car Purchase Decisions

Understand your car purchase options

When you’re ready to buy a car, one of the well-nigh important decisions you will face is how to pay for it. The choice between pay cash or financing affect more than fair your monthly budget — it impacts your overall financial health, credit score, and long term wealth building strategy.

Both payment methods offer distinct advantages and drawbacks. Your personal financial situation, goals, and current market conditions all play crucial roles in determine which approach makes the most sense for your circumstances.

The case for pay cash

Immediate ownership benefits

Pay cash mean you own the vehicle unlimited from day one. This complete ownership eliminate monthly payments, reduce insurance requirements, and give you full control over the asset. You can modify the vehicle as desire, sell it anytime without payoff complications, and avoid the stress of monthly payment obligations.

Cash purchases to simplify the buying process. Negotiations become more straightforward when financing isn’t iinvolved and you oftentimes gain stronger bargaining power. Dealers may offer additional discounts to cash buyers since they receive immediate payment without processing fees or financing complications.

Long term financial impact

The about obvious advantage of cash purchases is avoided interest charges. Over a typicafive-yearar loan term, interest can add thousands of dollars to your total costTheseis savings become more significant as interest rates rise or if your credit score limit you to higher rate loans.

Cash buyers besides avoid various financing relate fees, include loan origination charges, documentation fees, and extend warranty pressure. These costs can add several hundred to over a thousand dollars to finance purchases.

When cash make sense

Pay cash works advantageously when you have substantial emergency savings remain after the purchase. Financial experts recommend maintain three to six months of expenses in easy accessible accounts, yet after major purchases.

Source: etsy.com

Cash purchases too make sense for older vehicles or those with high mileage where financing terms might be unfavorable. Many lenders offer less attractive rates for vehicles over certain age or mileage thresholds, make cash more appealing.

The strategic value of financing

Preserving liquidity and flexibility

Financing allow you to maintain cash reserves for emergencies, investments, or other opportunities. This liquidity provides financial flexibility that disappear when you tie up large amounts in a depreciate asset.

Monthly payments too make budgeting more predictable. Alternatively of a large cash outlay, you can plan around consistent monthly expenses, which many people find easier to manage within their regular income flow.

Credit building opportunities

Auto loans can strengthen your credit profile when manage responsibly. They add to your credit mix, demonstrate payment reliability, and can improve your credit score over time. This benefit is specially valuable for younger buyers or those rebuild credit.

Nonetheless, this advantage exclusively applies if you make payments on time systematically. Late payments can damage your credit score more than the loan help it.

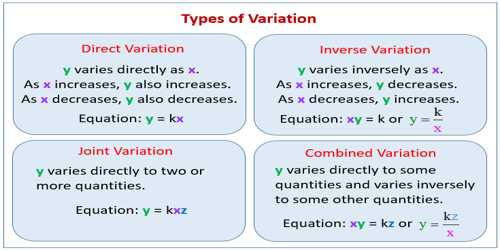

Investment opportunity costs

When auto loan rates are lower than potential investment returns, financing can make mathematical sense. If you can earn more invest your cash than you pay in loan interest, financing become a wealth building strategy.

This calculation require realistic assessment of investment returns and risk tolerance. Market volatility mean investment gains aren’t guarantee, while loan payments are fix obligations disregarding of market performance.

Evaluate your financial situation

Emergency fund considerations

Your emergency fund status should intemperately influence your decision. If pay cash would deplete your emergency savings, financing become more attractive despite interest costs. Financial security outweighs interest savings in most situations.

Consider your income stability, family obligations, and potential major expenses when evaluate emergency fund adequacy. Job security and health considerations besides factor into how much cash you should keep pronto available.

Debt and credit profile

Exist debt levels affect which option make more sense. If you carry high interest credit card debt, use cash for a car while maintain credit card balances create an inefficient debt structure. In such cases, finance the car at lower rates while sharply pay down credit cards might be smarter.

Your credit score determine available financing rates. Excellent credit might qualify for promotional rates near zero percent, make finance really attractive. Poor credit lead to high rate loans strengthen the case for cash purchases.

Income and budget stability

Steady income make monthly payments more manageable and less risky. Variable income or commission base earnings might favor cash purchases to avoid payment obligations during lean periods.

Consider your budget’s flexibility and other monthly obligations. Add a car payment to an already tight budget create stress and potential financial problems if circumstances change.

Market conditions and timing

Interest rate environment

Current interest rates importantly impact the cash versus finance decision. Low rate environments make financing more attractive, while high rates favor cash purchases. Promotional rates, peculiarly zero percent financing offers, can tip the scales toward finance yet for cash capable buyers.

Compare current auto loan rates to other investment opportunities and your exist debt rates. This comparison help determine whether financing costs are reasonable within your overall financial picture.

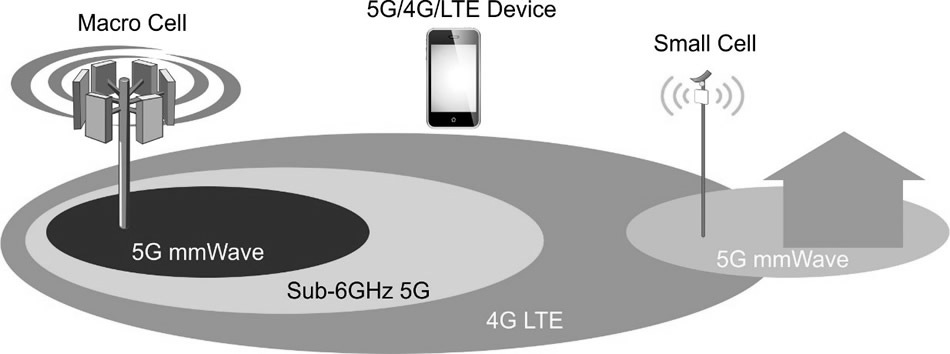

Vehicle depreciation factors

New vehicles depreciate quickly, lose significant value in the first few years. This depreciation affect finance purchases more since you might owe more than the vehicle’s worth initially. Cash buyers absorb the same depreciation but without the complication of negative equity.

Use vehicles typically depreciate more slow, make financing less problematic from an equity standpoint. Nonetheless, older vehicles might not qualify for the best financing rates, potentially favor cash purchases.

Make the right choice for your situation

Financial health assessment

Start by evaluate your complete financial picture. Calculate your net worth, monthly cash flow, and financial goals. Consider how each payment method aligns with your broader financial strategy and risk tolerance.

Factor in insurance implications, as finance vehicles require comprehensive coverage while cash purchases allow minimum coverage if desired. This insurance difference can add significant monthly costs to finance purchases.

Long term wealth impact

Consider the long term wealth implications of each choice. While avoid interest save money, maintain investment accounts might build more wealth over time. This calculation depend on investment performance, tax implications, and your investment discipline.

Remember that cars are depreciate assets disregarding of payment method. The goal is minimized the total cost of vehicle ownership while maintain financial flexibility and security.

Practical decision framework

Create a decision framework base on your priorities. If peace of mind and debt avoidance are paramount, cash might be preferable despite potential opportunity costs. If maintain liquidity and building credit are priorities, financing could be better despite interest expenses.

Consider hybrid approaches, such as make a large down payment to reduce financing needs while preserve some cash reserves. This strategy can optimize both payment amounts and financial flexibility.

Common mistakes to avoid

Don’t deplete all savings for a cash purchase, leave yourself vulnerable to emergencies. Maintain adequate reserves yet if it means finance part of the purchase.

Avoid financing but to build credit if you’ve established credit already. The credit building benefit diminish if you already have good credit, make interest payments unnecessary.

Don’t assume financing is invariably more expensive without calculate total costs. Sometimes manufacturer incentives or promotional rates make financing cheaper than pay cash, specially when cash discounts aren’t offer.

Resist the temptation to buy more car when financing make payments seem affordable. Monthly payment affordability doesn’t need mean the total purchase price fit your budget fittingly.

Final considerations

The cash versus financing decision isn’t strictly mathematical — it involves personal comfort levels, financial goals, and life circumstances. Some people sleep comfortably without monthly payments, while others prefer maintain cash flexibility careless of interest costs.

Consider your financial discipline and investment habits. If you’re likely to spend cash reserves frivolously kinda than invest them profitably, pay cash for the car might enforce better financial behavior.

Remember that you can oftentimes change your approach with future purchases as your financial situation evolve. The right choice today might not be the right choice in five years when your shop again.

Source: allocine.fr

Finally, both cash and financing can be smart choices depend on your circumstances. The key is make an informed decision base on your complete financial picture kinda than follow general rules that might not apply to your situation.

MORE FROM feelmydeal.com