Disney Vacation Financing: Options for Purchasing Theme Park Tickets

Disney ticket financing: understand your options

Disney theme parks offer magical experiences for families, but the cost of admission can be substantial. A common question many potential visitors ask is whether Disney tickets can be finance. The short answer is yes — there be several ways to spread out the cost of Disney tickets, though traditional financing options are limited.

Official Disney payment plans

Disney doesn’t offer direct financing for standalone ticket purchases in the traditional sense of loans or credit. Nonetheless, they do provide some payment flexibility:

Disney vacation package payment plans

While you typically can’t finance individual tickets, dDisneydoes offer payment plans for vacation packages that include tickets:

- Walt Disney World and Disneyland resort allow guests to book vacation packages with a small deposit (typically $$200))

- The remain balance is due 30 days before arrival.

- Between booking and the final payment date, you can make payments of any amount at any time.

- This isn’t technically finance as there be no interest or credit check, but it does allow you to spread payments over time.

Annual pass monthly payments

For frequent visitors, Disney offer monthly payment plans for annual passes:

- Florida residents can purchase walt Disney World annual passes with monthly payments after a down payment.

- California residents have similar options for Disneyland annual passes.

- These plans divide the cost over 12 months, though they typically require residency in the respective states.

Third party financing options

When official Disney payment plans don’t meet your needs, several third party options exist:

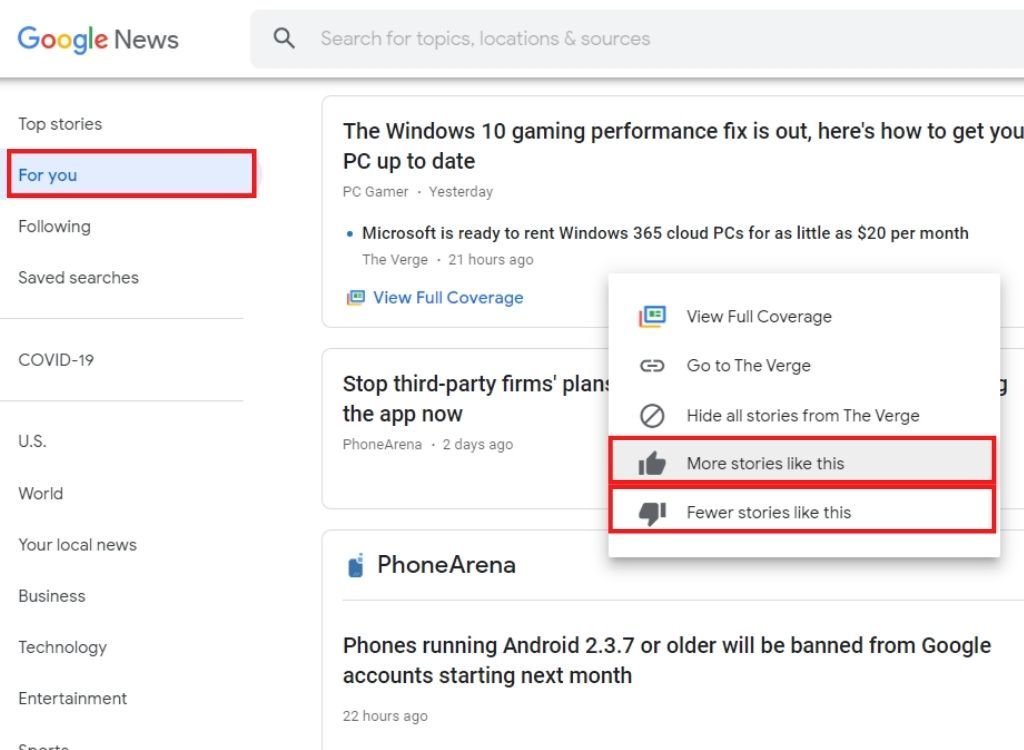

Credit cards

Credit cards represent the almost common way people finance Disney tickets:

- Regular credit cards allow you to pay for tickets directly and pay off the balance over time.

- Cards with 0 % introductory Apr offers can provide interest free financing for 12 18 months.

- Disney visa cards offer special Disney perks and financing options for Disney purchases.

- Some cards offer Disney specific rewards or cash backrest that can offset ticket costs.

When use credit cards, calculate the total cost include interest to ensure this approach make financial sense. Pay the minimum monthly payment can importantly increase the final cost of your Disney experience.

Buy immediately, pay later services

Modern financing alternatives have emerged in recent years:

- Services like affirm, Afterpay, and Klarna partner with some authorize Disney ticket resellers.

- These platforms typically split payments into 4 12 installments.

- Some offer interest free options if pay within a specific timeframe.

- Approval is oftentimes instant and may not require a hard credit check.

Check the specific terms cautiously, as interest rates can be high if you don’t qualify for promotional rates.

Personal loans

For larger Disney vacations, some visitors consider personal loans:

- Banks, credit unions, and online lenders offer personal loans that can cover Disney expenses.

- These typically have fixed interest rates and predictable monthly payments.

- Loan terms commonly range from 12 60 months.

- Interest rates vary base on your credit score and financial situation.

While personal loans provide structure, they’re mostly more appropriate for finance entire vacations kinda than fair tickets due to minimum loan amounts and application processes.

Authorized Disney ticket resellers

Several authorize Disney ticket resellers offer their own payment options:

- Companies like undercover tourist, get outside today, and park savers sometimes offer layaway or payment plan options.

- These plans may allow you to lock in current ticket prices while pay over time.

- Terms vary by company, with some charge service fees for payment plans.

Ever verify that you’re work with an authorized Disney ticket reseller to avoid scams.

Saving strategies as alternatives to financing

Before commit to finance Disney tickets, consider these saving strategies:

Dedicated Disney savings account

Create a dedicated savings plan can be more economical than financing:

Source: disneyparksaddict.com

- Set up an automatic transfer to a separate savings account for your Disney fund.

- High yield savings accounts can help your Disney fund grow fasting.

- This approach avoid interest charges and potential debt.

- Many banks allow you to create custom savings goals or sub accounts for specific purposes.

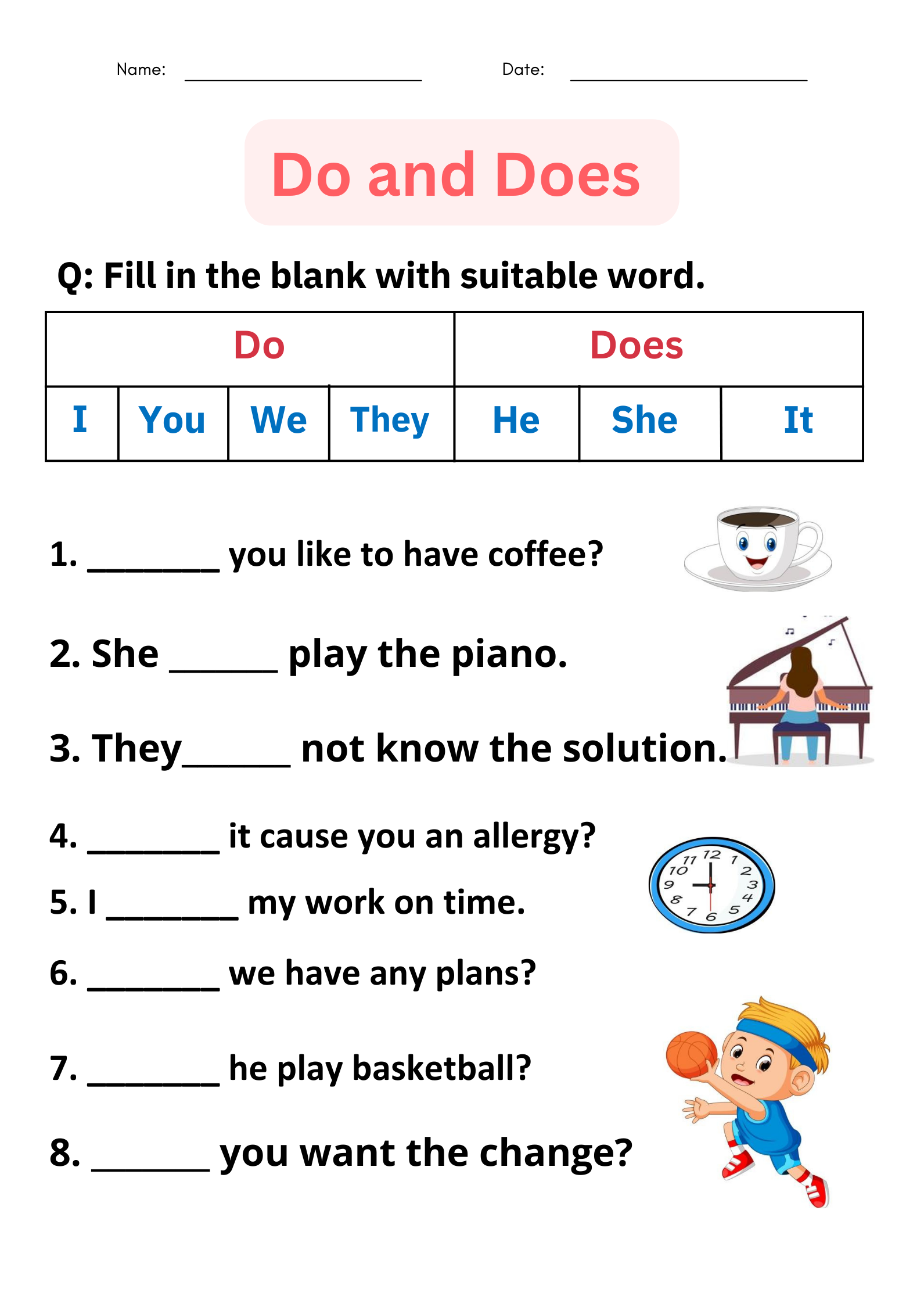

Disney gift cards

Gradually purchase Disney gift cards can serve as a form of self-financing:

- Buy Disney gift cards sporadically to spread out the expense.

- Look for discount gift cards at warehouse clubs like Sam’s club or Costco.

- Some credit card reward programs offer Disney gift cards as redemption options.

- Target red card holders can save 5 % onDisneyy gift card purchases.

Disney vacation account alternative

While Disney discontinue their official vacation account program, you can create your own version:

- Calculate the total cost of your plan Disney experience.

- Determine how many months until your trip.

- Divide the cost by the number of months to establish a monthly savings target.

- Set up automatic transfers to ensure consistent saving.

Discount strategies to reduce financing needs

Reduce the overall cost can minimize how practically you need to finance:

Time your visit

Strategic timing can importantly reduce ticket costs:

- Visit during off-peak seasons when ticket prices are lower (typically jJanuaryfFebruary sSeptemberoOctober)

- Multi day tickets offer better per day value than single day tickets.

- Avoid holiday periods and summer peaks when prices are highest.

- Consider weekday visits, which sometimes have lower pricing than weekends.

Special discounts

Various discounts can reduce your ticket financing need:

- Military discounts offer substantial savings for active and retired service members.

- Florida and California resident discounts for their respective parks.

- Corporate partnerships sometimes provide employee discount programs.

- AAA, teacher, student, and senior discounts may be available during certain promotions.

Package deals

Bundling can sometimes provide better value and payment flexibility:

- Disney vacation packages that include hotel stays oftentimes have more favorable payment terms.

- Authorized travel agencies may offer special package deals with payment plans.

- Add dining plans or other components may qualify you for special promotions or financing options.

Financial considerations before financing Disney tickets

Before proceed with any financing option, consider these financial factors:

Total cost analysis

Understand the true cost of financing is essential:

- Will calculate the total amount you’ll pay will include all interest and fees.

- Compare this to the cash price to determine the premium you’re pay for financing.

- Consider whether the additional cost justifies not wait and save.

Budget impact

Will assess how financing will affect your overall financial health:

- Ensure monthly payments fit well within your budget.

- Will consider how yearn you’ll be make payments after your Disney experience has will end.

- Evaluate whether financing Disney tickets might prevent you from address other financial priorities.

Remember that vacation expenses extend beyond tickets — food, souvenirs, transportation, and accommodations add importantly to the total cost.

Alternative experiences

If financing seem also costly, consider these alternatives:

- Visit during a special promotion or discount period.

- Explore less expensive Disney experiences like Disney springs or downtown Disney (no admission require )

- Plan a shorter visit with fewer park days.

- Postpone your visit until you can save enough to avoid financing.

Plan for future Disney visits

For those who love Disney experiences, develop a long term strategy can reduce the need for financing:

Disney vacation club

For frequent Disney visitors, Disney vacation club (dDVC)offer a way to prpre-payor accommodations:

- This timeshare like program allow members to purchase points usable for Disney accommodations.

- Financing options are available for DVC membership.

- While this doesn’t straightaway finance tickets, it can reduce overall vacation costs.

Annual pass considerations

For multiple visits within a year, annual passes can provide value:

- Calculate whether an annual pass (perhaps with monthly payments )would be more economical than multiple individual tickets.

- Annual passes include benefits like parking and discounts that air reduce costs.

- Monthly payment options make this a form of financing with add benefits.

The bottom line on financing Disney tickets

While Disney doesn’t offer traditional financing for individual ticket purchases, multiple options exist to spread out payments:

Source: disneyinsidertips.com

- Disney vacation packages offer deposit base payment plans.

- Credit cards and buy nowadays pay later services provide flexible financing options.

- Authorized resellers sometimes offer layaway or payment plans.

- Save strategies can be more economical than financing.

The virtually financially sound approach is typically to save in advance for Disney expenses, but when that’s not possible, understand all available payment options can help make your Disney dream more accessible. Invariably calculate the total cost of financing and ensure it fit within your overall financial plan before commit.

Remember that the magic of Disney come from the experience itself, not needfully from visit during peak times or stay at the about expensive resorts. With careful planning and strategic use of payment options, create magical memories can be achieved without create long term financial stress.

MORE FROM feelmydeal.com