Entertainment Budget: Understanding Average Monthly Spending Habits

Entertainment budget: understand average monthly spending habits

Entertainment expenses form a significant part of most Americans’ monthly budgets. From streaming services to concerts, dine out to movie tickets, these costs can add up rapidly. Understand the average entertainment spending patterns can help you evaluate your own habits and make informed decisions about your leisure budget.

What constitute entertainment spending?

Before discuss average figures, it’s important to clarify what fall under the entertainment category:

- Streaming services (nNetflix hHulu dDisney, etc. )

- Cable or satellite TV

- Movie theater tickets

- Concerts and live performances

- Sporting events

- Video games and gaming subscriptions

- Books, magazines, and music purchases

- Dine out (sometimes categorize as entertainment kinda than food )

- Hobbies and recreational activities

- Amusement parks and attractions

Average monthly entertainment spending in America

Accord to data from the bureau of labor statistics’ consumer expenditure survey, the average American household spend roughly $270 to $$300per month on entertainment. This rerepresentspproximately 5.3 % of the average household’s total spending.

Nonetheless, these figures vary importantly base on several factors:

Age group differences

Entertainment spending follow distinct patterns across age groups:

Source: nfcc.org

- Young adults (under 25 ) Despite typically have lower incomes, this group much allocate a higher percentage of their budget to entertainment, average $170 $200 monthly. Their spending focus intemperately on digital entertainment, streaming services, and social activities.

- Adults 25 34: This demographic spends roughly$2300 $260 monthly on entertainment, with increase focus on home base entertainment as family responsibilities grow.

- Adults 35 54: The highest entertainment spenders, average $320 $380 monthly, much due to family orient entertainment expenses and higher disposable income.

- Adults 55 +: Entertainment spending typically decreases to$2000 $250 monthly, with shifts toward travel, dining, and cultural events kinda than technology base entertainment.

Income level impact

Not amazingly, income importantly influence entertainment spending:

- Lower income households (under $$30000 yearly )) Average $120 $150 monthly on entertainment ((oughly 7 % of their budget ))

- Middle income households ($$30000 $70,000 )) Average $200 $250 monthly ((pproximately 5 6 % of their budget ))

- Higher income households ($$70000 + )) Average $350 $500 + monthly ((pproximately 4 5 % of their budget ))

Interestingly, while higher income households spend more in absolute dollars, they much allocate a smaller percentage of their overall budget to entertainment.

Geographic variations

Location plays a crucial role in entertainment spending:

- Urban areas: Residents typically spend 15 20 % more on entertainment than the national average due to higher costs and greater access to entertainment options.

- Suburban areas: Spend aligns nearly with the national average.

- Rural areas: Residents mostly spend 10 15 % less than the national average, partially due to fewer entertainment venues and lower costs.

Family size and composition

Family structure dramatically affects entertainment budgets:

- Single individuals: Average $180 $220 monthly

- Couples without children: Average $250 $300 monthly

- Families with children: Average $350 $450 monthly, with significant variations base on children’s ages and family size

Breakdown of entertainment spending categories

Understand where entertainment dollars typically go can help contextualize your own spending habits:

Digital entertainment services

The average American household presently subscribes to 3 4 streaming services, spend roughly$400 $60 monthly on these platforms. When combine with other digital subscriptions like gaming services, music streaming, and digital publications, this category much account for $60 $80 of monthly entertainment spending.

Traditional cable and television

Despite the rise of streaming, many Americans stock still maintain cable or satellite TV subscriptions, spend an average of $85 $110 monthly. This figure has been steady decline as more consumers cut the cord in favor of stream alternatives.

Live entertainment

Americans spend around $50 $75 monthly on live entertainment such as concerts, sporting events, theater performances, and movie theaters. This category see the almost significant seasonal fluctuations, with summer months typically show higher spending.

Recreational activities and hobbies

From golf green fees to craft supplies, Americans spend an average of $50 $70 monthly on recreational activities and hobby relate expenses.

Dine out as entertainment

While oftentimes categorize individually, many Americans consider certain dining experiences as entertainment kinda than necessary food expenses. When included, thisaddsd roughl$10000 $150 to monthly entertainment spending.

Recent trends in entertainment spending

Shift toward digital

Consumer spending has progressively moved toward digital entertainment options. Streaming services haveseene substantial growth, with the average number of subscriptions per household continue to rise. This trenaccelerateste during the pandemic and has mostmaintainedain momentum.

Experience base entertainment

Post pandemic, there be been renewed interest in experience base entertainment. Concerts, live sporting events, and other in person activities havseenee strong rebounds as consumers seek social experiences after periods of isolation.

Game growth

Video game spending has grown considerably, withAmericanss nowadays spend roughly 30 % more on gaming than they do five yearsalonee. Thisincludese not exactly game purchases but besides in game transactions, subscriptions, and hardware.

Subscription fatigue

A countertrend to the digital shift is” subscription fatigue, ” here consumers become overwhelmed by multiple recur payments. This has lead to more strategic subscription management, with many households regularly evaluate and rotate their entertainment subscriptions.

How to evaluate your entertainment spending

To determine if your entertainment budget aligns with your financial goals:

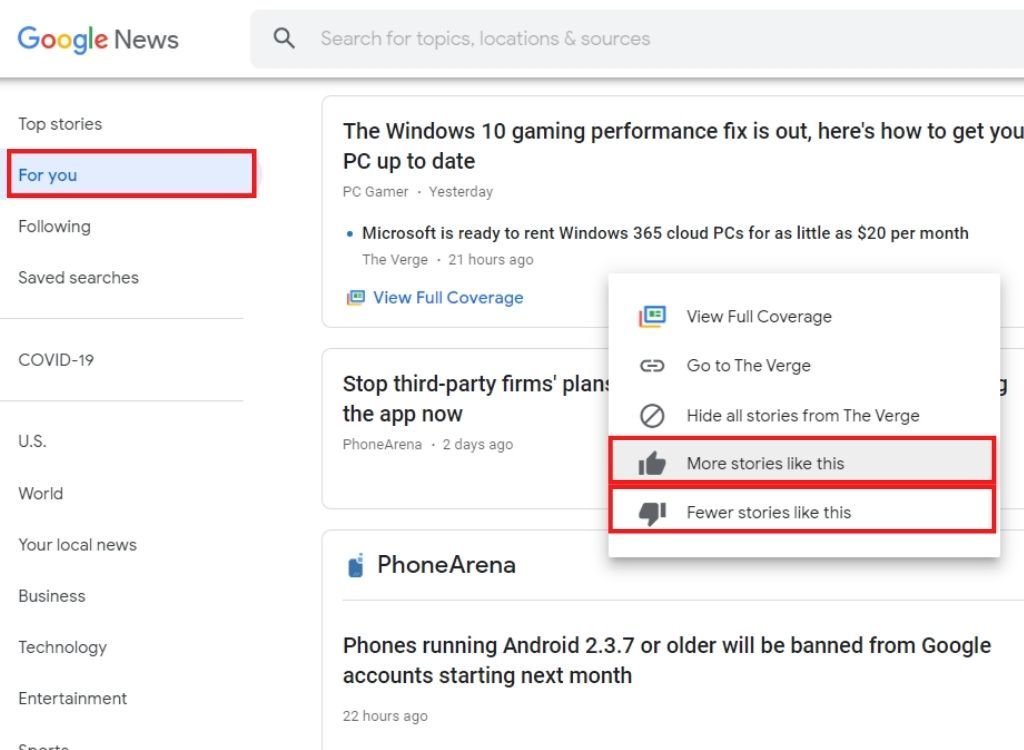

Track your current spending

Before make judgments about your entertainment budget, track your actual spending for 2 3 months. Many people underestimate their entertainment costs, specially when they include small, frequent purchases like app downloads or coffee shop visits that serve as social entertainment.

Compare to recommend budgeting guidelines

Financial experts typically recommend allocate 5 10 % of your after tax income to entertainment and recreation. This provides a personalize benchmark base on your specific financial situation preferably than compare to national averages that may not reflect your circumstances.

Consider your financial priorities

Your entertainment spending should align with your broader financial goals. If you’re work toward major financial objectives like debt reduction or save for a home, you might temporarily reduce your entertainment budget below the typical guidelines.

Assess value receive

Beyond fair track dollars spend, evaluate the enjoyment and value you receive from different entertainment categories. This can help you reallocate spending from low value entertainment to options that provide more satisfaction.

Strategies to optimize entertainment spending

If you’re look to get more value from your entertainment budget:

Audit subscriptions regularly

Review all subscription services quarterly. Consider implement a rotation strategy where you subscribe to different services throughout the year sooner than maintain altogether simultaneously.

Utilize free and low-cost alternatives

Explore free entertainment options like public libraries (which directly oftentimes offer digital content ) community events, free museum days, and public parks. Many communities offer robust calendars of free cultural events, especially during summer months.

Look for bundle opportunities

Many entertainment services offer discount bundles. Likewise, memberships to cultural institutions like museums or zoos oftentimes provide better value than individual visit tickets if you plan to attend multiple times per year.

Plan major entertainment purchases

For larger entertainment expenses like concert tickets or vacations, create dedicated sink funds kinda than use credit or deplete your regular entertainment budget.

Consider the social component

Some of the virtually memorable entertainment experiences involve social connection. Host game nights or potluck dinners can provide substantial entertainment value at a fraction of the cost of commercial entertainment options.

Source: mybudget360.com

Balance entertainment and financial responsibility

Entertainment spending represent more than exactly discretionary expenses — it reflects quality of life and psychologicalwell-beingg. Research systematically show that experiences( quite than material goods) contribute importantly to happiness and life satisfaction.

The key is found the right balance for your specific situation:

Prioritize mindful spending

Instead than eliminate entertainment, focus on mindful consumption. This mean being intentional about which entertainment options unfeignedly enhance your life and bring joy versus those that but fill time or stem from habit.

Build entertainment into your financial plan

Acknowledge entertainment as a legitimate need instead than view it as strictly frivolous. By explicitly budget for entertainment, you can enjoy leisure activities without guilt while maintain financial boundaries.

Adjust base on life circumstances

Entertainment budgets should flex with your life circumstances. During financially challenging periods, you might need to reduce entertainment spending temporarily. Conversely, after achieve major financial milestones, you might moderately increase your entertainment allocation.

Conclusion

While the average American household spend $270 $300 monthly on entertainment, your optimal budget may differ importantly base on income, location, family size, and personal preferences. The virtually important factor isn’t how your spending compare to national averages but whether your entertainment budget aligns with your financial goals and provide genuine enjoyment.

By understand typical spending patterns and implement thoughtful strategies, you can create an entertainment budget that enhance your quality of life while support your long term financial health. Remember that the goal isn’t needfully to minimize entertainment spending but to maximize the value and joy you receive from each dollar spend on leisure activities.

MORE FROM feelmydeal.com