Essential Finance Questions: Your Complete Guide to Financial Literacy

Understand personal finance fundamentals

Financial literacy serve as the foundation for make sound money decisions. Without a clear understanding of basic financial concepts, navigate the complex world of personal finance become challenging. Let’s explore the essential questions that can help build your financial knowledge.

How to create an effective budget

A budget represent the cornerstone of financial stability. To create an effective budget, start by track all income sources and categorize expenses into fixed and variable costs. The 50/30/20 rule offer a simple framework: allocate 50 % of income to needs, 30 % to wants, and 20 % to savings and debt repayment.

Many people struggle with budgeting because they make it overly complicated. Use digital tools like budgeting apps to streamline the process. Remember that a good budget provide flexibility while keep you accountable to your financial goals.

What’s the difference between saving and investing?

Save and investing represent two distinct approaches to manage money. Save involve set aside money in secure, liquid accounts like savings accounts or certificates of deposit. These vehicles offer minimal risk but provide limited growth potential.

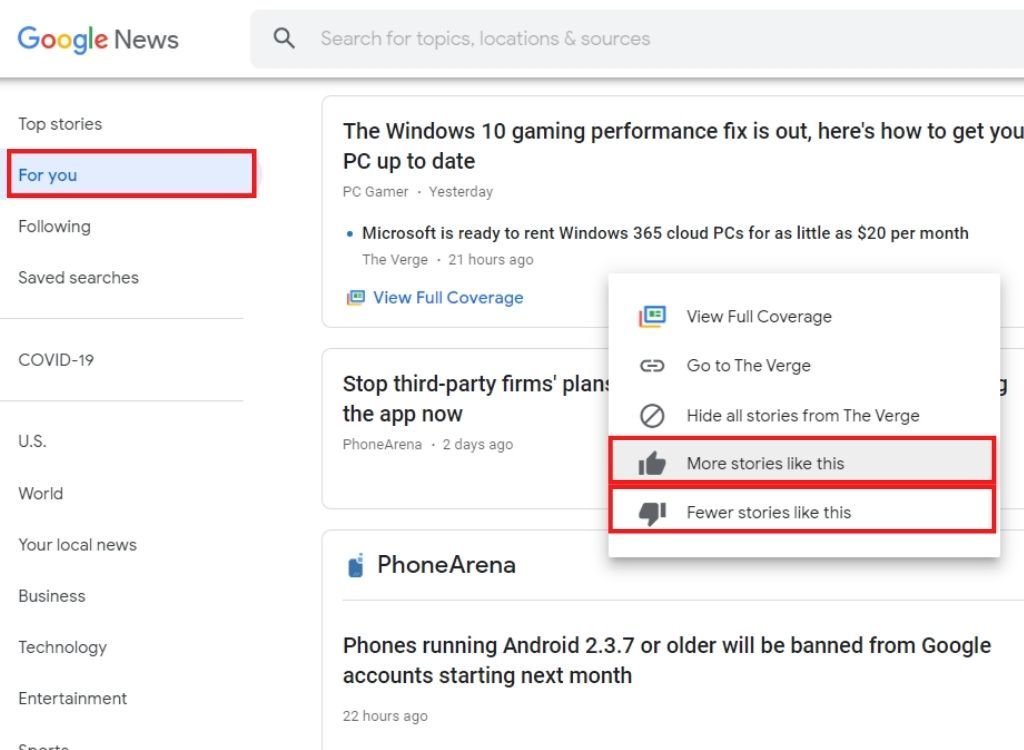

Source: clevergirlfinance.com

Investing, notwithstanding, mean put money into assets with the expectation of generate returns over time. Common investment vehicles include stocks, bonds, mutual funds, and real estate. While invest carry higher risk than save, it offers the potential for significant long term growth that outpace inflation.

A balanced financial plan typically includes both strategies: save for short term needs and emergencies, and invest for long term goals like retirement.

Manage debt efficaciously

How do I prioritize debt repayment?

Debt management require strategic thinking. When face multiple debts, consider these approaches:

- Avalanche method focus on high interest debts 1st while make minimum payments on others. This approach save the most money in interest over time.

- Snowball method pay off smallest debts 1st, disregarding of interest rate. This ccreatespsychological wins that build momentum.

- Consolidation combine multiple debts into a single loan with a lower interest rate to simplify payments and potentially reduce interest costs.

Whichever method you choose, consistency matter virtually. Create a repayment plan and stick with it, make at least minimum payments on all debts to avoid penalties and credit damage.

What’s consider a good credit score?

Credit scores typically range from 300 to 850, with higher scores indicate better creditworthiness. Broadly, scores break down as follows:

- Excellent: 800 850

- Identical good: 740 799

- Good: 670 739

- Fair: 580 669

- Poor: below 580

A good credit score (670 or supra )help secure favorable terms on loans, credit cards, and level insurance premiums. To build and maintain good credit, pay bills on time, keep credit utilization below 30 %, maintain foresightful stand accounts, and apply for new credit meagerly.

Retirement planning essentials

How practically should I save for retirement?

Retirement planning depend on individual circumstances, but financial experts frequently recommend save 10 15 % of your gross income throughout your working years. The actual amount need varies base on:

- Desire retirement lifestyle

- Expect retirement age

- Anticipated longevity

- Healthcare need

- Other income sources (social security, pensions )

A common guideline suggests aim to replace 70 80 % of pre retirement income. Use retirement calculators can provide personalized estimates base on your specific situation and goals.

What retirement accounts should I consider?

Various retirement accounts offer different tax advantages and features:

- 401(k)/403(b) employer sponsor plans that allow ppre-taxcontributions, reduce current taxable income. Many employers offer matching contributions, provide immediate returns on your investment.

- Traditional IRA individual retirement account with ttax-deductiblecontributions and tax defer growth. Taxes apply when withdraw funds in retirement.

- Roth IRA contributions make with after tax dollars, but qualified withdrawals in retirement are totally ttax-free include earnings.

- Sep IRA and solo 401(k) options for self employ individuals that allow higher contribution limits than standard iIRAs

Diversify across different account types can provide tax flexibility in retirement. Consider consult with a financial advisor to determine the optimal mix for your situation.

Investment strategy questions

How do I start invest with limited funds?

Invest nobelium yearn require substantial capital to begin. Consider these approaches for new investors with limited funds:

- Micro investing apps platforms like acorns or stash allow investments start at equitable $$5 much round up everyday purchases and invest the spare change.

- Fractional shares many brokerages directly offer the ability to purchase portions of expensive stocks, make diversification possible with small amounts.

- Index funds and ETFs these provide instant diversification at low cost, with many require minimal initial investments.

- Employer retirement plans contribute flush small percentages to 401(k )plans, particularly with employer matching, jumpstart investment growth.

The virtually important aspect of invest with limit funds is consistency. Regular contributions, regular small ones, benefit from compound growth over time.

What’s the difference between active and passive investing?

Active and passive investing represent two essentially different approaches to grow wealth:

Active investing Involve attempt to outperform market benchmarks through strategic selection of investments. This approach typically involves:

- Frequent trading base on market analysis

- Higher management fees

- Potential for outperformance (though statistics show nearly active managers underperform their benchmarks over long periods )

- Greater time commitment for research and monitoring

Passive investing Aim to match market performance quite than beat it, typically done:

- Index funds that track specific market benchmarks

- Lower fees and expenses

- Less frequent trading and lower tax consequences

- Minimal time requirements for management

Many successful investors combine both approaches, use passive strategies for core holdings while selectively apply active strategies in specific market segments.

Tax planning considerations

How can I minimize my tax burden lawfully?

Tax planning represent an oft overlook aspect of financial management. Legal tax minimization strategies include:

- Maximize tax advantage accounts contribute to 401(k)s, iIRAs hhas and 529 plans provide immediate or future tax benefits.

- Tax loss harvesting sell investments at a loss to offset capital gains, potentially reduce tax liability.

- Time income and deductions strategically accelerate or delay certain financial transactions base on tax implications.

- Charitable giving donations to qualified organizations can provide tax deductions while support causes you care about.

- Tax credits take advantage of available credits like the child tax credit, earn income credit, or education credits.

Work with a qualified tax professional can help identify specific strategies suit to your financial situation. Remember that tax avoidance (legal minimization )differ from tax evasion ( (legal nonnon-payment)

What tax deductions am I eligible for?

Common tax deductions that many taxpayers overlook include:

- Standard vs. Itemize deductions choose whichever provide the greater benefit. Itemize make sense when deductions for mortgage interest, charitable contributions, medical expenses, and state / local taxes exceed the standard deduction.

- Self-employment deductions business expenses, home office deductions, and self employ retirement plans can importantly reduce taxable income for entrepreneurs.

- Education relate deductions student loan interest, qualified education expenses, and certain education credits can reduce tax liability for students and parents.

- Healthcare deductions medical expenses exceed 7.5 % of adjusted gross income can be deductible if iitemized

Tax laws often change, hence stay inform about current deductions and credits help maximize tax savings. Maintain organize records throughout the year simplify the process of claim eligible deductions.

Insurance and risk management

What types of insurance do I rattling need?

Insurance provide financial protection against life’s uncertainties. While individual needs vary, most people should consider these essential coverage types:

- Health insurance protects against potentially catastrophic medical expenses. Yet with high deductibles, coverage for serious illness or injury prevent financial ruin.

- Auto insurance require in most states, this cover liability for damages you cause to others. Additional coverage protect your own vehicle.

- Homeowners / renters insurance protect your dwelling and possessions against damage or theft, plus provide liability coverage for accidents on your property.

- Life insurance essential if others depend on your income. Term life insurance offer affordable death benefit protection for specific periods.

- Disability insurance replaces a portion of income if you become unable to work due to illness or injury — oftentimes overlook but statistically more likely to be need than life insurance during work years.

Additional coverage like umbrella liability, long term care, or professional liability insurance may be appropriate to depend on your specific circumstances and risk factors.

How much life insurance do I need?

Life insurance needs to vary base on individual circumstances, but common calculation methods include:

- Income replacement method multiply your annual income by 10 15 to determine coverage needs.

- Dime formula add up debt, income ((uture years need ))mortgage balance, and education costs for dependents.

- Human life value calculate the present value of all future income you’d have eearned

Consider factors like outstanding debts, mortgage balance, future education expenses, funeral costs, and replace lose income. For those with no dependents or significant financial obligations, minimal coverage may suffice, while those support families typically need more substantial protection.

Estate planning basics

Do I need a will, and what should it include?

Everyone with assets or dependents benefits from have a will, disregardless of age or wealth level. A basic will should include:

- Designation of beneficiaries for your assets

- Appointment of an executor to manage your estate

- Guardianship nominations for minor children

- Specific bequests for personal items with sentimental value

- Instructions for digital assets and accounts

Without a will, state intestacy laws determine asset distribution, which may not align with your wishes. Additionally, guardianship decisions for minor children could be left to court determination. While online will creation tools exist, consult with an estate planning attorney ensure your document addresses all legal requirements in your jurisdiction.

What’s the difference between a will and a trust?

Wills and trusts serve different but complementary functions in estate planning:

Wills

- Take effect solely after death

- Must go through probate (public court process )

- Allow guardianship designations for minor children

- Can be change or revoke during lifetime

- Cover lonesome assets in your name at death

Trusts

- Can be effective instantly upon creation

- Avoid probate when decent fund

- Provide privacy (not public record )

- Can manage assets during incapacity

- Can continue manage assets for beneficiaries after death

- May offer tax advantages for larger estates

Many comprehensive estate plans will include both a will and trust, with the will oft will contain a” pour over ” rovision will direct any will remain assets into the trust after death.

Financial emergency preparedness

How large should my emergency fund be?

Financial experts typically recommend maintain an emergency fund cover 3 6 months of essential expenses. Nevertheless, the ideal size depends on several factors:

- Income stability those with variable income ((reelancers, commission base workers ))r specialized careers with limited job opportunities may need larger reserves, peradventure 6 12 months.

- Family situation single income households or families with dependents broadly benefit from larger emergency funds than dual income households or singles.

- Health considerations people with chronic health conditions or high deductible health plans may need additional reserves for potential medical expenses.

- Fixed obligations those with higher fix expenses ((ortgages, loan payments ))elative to income should aim for larger emergency savings.

Emergency funds should be keep in liquid, easy accessible accounts like high yield savings accounts or money market funds, where they earn some interest while remain pronto available.

What financial documents should I keep and for how long?

Organized financial records simplify tax preparation, loan applications, and estate planning. Follow these retention guidelines:

Keep permanently

- Birth, marriage, and death certificates

- Social security cards

- Military discharge papers

- Estate planning documents (wills, trusts, power of attorney )

- Life insurance policies

- Retirement plan documents

- Property deeds and vehicle titles

Keep for 7 years

- Tax returns and support documentation

- Property improvement records

- Home purchase / sale documents

- Loan documents (until pay off, so keep discharge notice )

Keep for 1 year

- Monthly bank statements

- Pay stubs (until reconcile with w 2 )

- Utility bills (unless need for tax purposes )

- Credit card statements (unless need for tax documentation )

Consider use a combination of secure physical storage (fireproof safe or ssafe deposit box) )d encrypt digital storage with backup for important documents.

Building long term financial security

How do I balance multiple financial goals?

Most people juggle compete financial priorities like debt repayment, emergency savings, retirement planning, and short term goals. To balance these efficaciously:

Source: studylib.net

- Prioritize high interest debt address credit card or high interest loans firstly, as their cost typically exceed investment returns.

- Capture employer matches contribute sufficiency to retirement accounts to receive full employer matching funds — this rrepresentsan immediate 50 100 % return.

- Build a basic emergency fund establish at least 1 2 months of expenses before accelerate other goals.

- Use parallel progress allocate different percentages of income to multiple goals simultaneously instead than focus entirely on one goal at a time.

- Automate contributions set up automatic transfers to various savings and investment accounts to ensure consistent progress.

Regularly reassess priorities as life circumstances change. Financial planning represent an ongoing process kinda than a one time decision.

When should I consult a financial advisor?

While many aspects of personal finance can be self-manage, certain situations warrant professional guidance:

- Major life transitions marriage, divorce, birth of children, career changes, inheritance, or approach retirement.

- Complex financial situations business ownership, stock options, multiple income sources, or significant assets.

- Estate planning needs substantial assets, blend families, special needs dependents, or charitable give goals.

- Investment complexity portfolio exceed your comfort level for sself-managementor require specialized knowledge.

- Tax planning opportunities high income, multiple income sources, or significant investment gains.

When select an advisor, understand their compensation structure (fee solely, commission base, or fee base )and verify credentials such as cfCFP (rtified financial planner ),)fa CFAh(tered financial analyst ), o)cpa wiCPApfs ( PFSs(al financial specialist ) desi)ation. Interview multiple candidates to find someone whose communication style and philosophy align with your needs.

Financial literacy resources

Continue financial education represent an investment in your future. Valuable resources include:

- Government websites consumer financial protection bureau ((onsumerfinance.gov ))nd securities and exchange commission ( i(estor.gov ) o)er unbiased educational materials.

- Nonprofit organizations national foundation for credit counseling and jjumpstartcoalition provide free resources and tools.

- Personal finance books classics like ” ersonal finance for dummies, “” e total money makeover, ” ” ” y” money or your life ” of” comprehensive guidance.

- Online courses many universities and financial institutions offer free or low cost personal finance courses.

- Financial podcasts audio programs cover various financial topics provide convenient learning opportunities during commutes or exercise.

Remember that financial education represent an ongoing process. As markets, tax laws, and personal circumstances evolve, continue to expand your knowledge ensure inform decision-making.

By will address these fundamental finance questions, you will develop the knowledge will need to make confident financial decisions. Remember that personal finance remain personal — the right approach depend on your unique goals, risk tolerance, and life circumstances. Start with small steps, maintain consistency, and regularly reassess your strategy as life evolve.

MORE FROM feelmydeal.com