Holdbacks in Finance: Understanding the Strategic Retention of Funds

What’s a holdback in finance?

A holdback in finance refer to a portion of funds that’s temporarily withhold from a payment or transaction until certain conditions are meet. This financial mechanism serves as a form of security or protection for the party provide the funds, ensure that contractual obligations are fulfilled before the full payment is release.

Holdbacks are wide use across various financial transactions and industries to mitigate risks and protect the interests of involved parties. They fundamentally function as a financial safeguard that help maintain accountability and ensure compliance with agree upon terms.

Key purposes of financial holdbacks

Holdbacks serve several important purposes in financial transactions:

Risk mitigation

The primary purpose of a holdback is to reduce risk for the party provide funds. By withhold a portion of the payment, the payer maintains leverage to ensure the recipient complete their obligations satisfactorily. This is peculiarly important in scenarios where the full value or quality of goods or services can not be instantly verify.

Performance guarantee

Holdbacks incentivize the reception party to fulfill all contractual obligations. Know that a portion of payment is contingent upon satisfactory performance encourage thoroughness and compliance with agree standards.

Dispute resolution mechanism

If issues arise during a transaction, the holdback amount provides a financial buffer that can beusede to address problems without require additional payments or complex recovery processes. This build in contingency fund simplifies the resolution of potential disputes.

Protection against unforeseen issues

Holdbacks provide protection against undisclosed liabilities, defects, or other problems that might but become apparent after a transaction has been initiated. They allow time for thorough assessment before release the full payment.

Common types of holdbacks

Holdbacks appear in various forms across different financial contexts:

Construction holdbacks

In construction projects, holdbacks (sometimes call rretain ag) are standard practice. Typically, 5 10 % of each payment is wwithhelduntil project completion and verification that all work meet the rrequirementspecifications. Thprotectsect property owners from defects or incomplete work while ensure contractors remain committed throughout the project duration.

Construction holdbacks oftentimes follow a two stage release pattern:

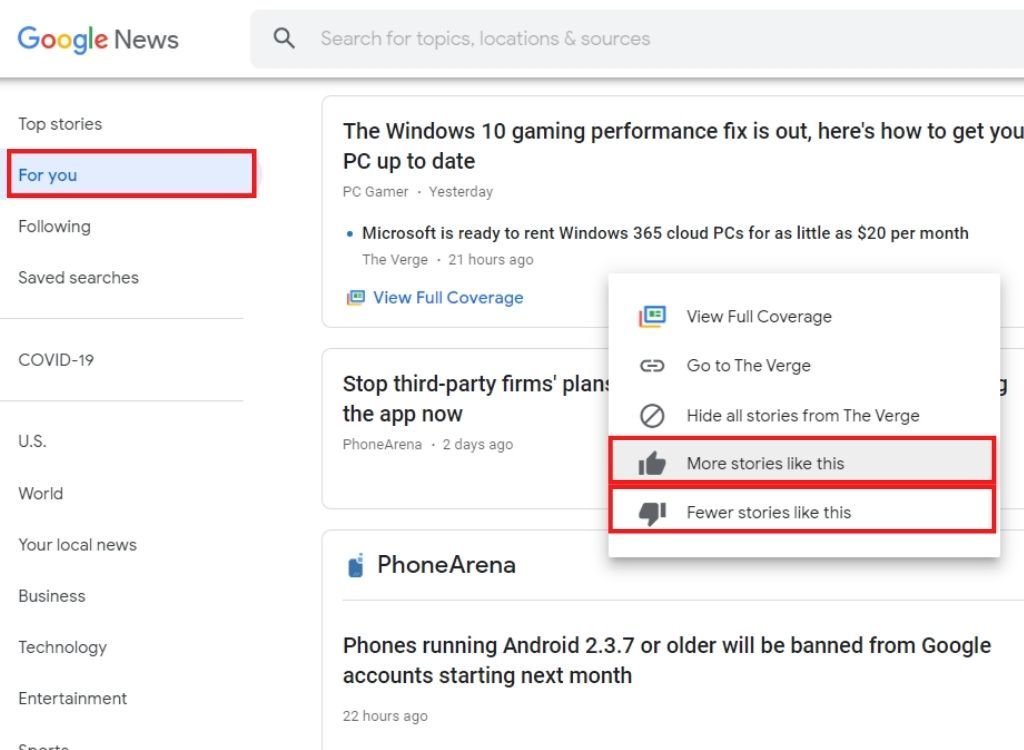

Source: albeca.com

- Substantial completion holdback: release when the project reaches a predefine level of completion

- Final completion holdback: release after a defect liability period has pass without issues

Merger and acquisition holdbacks

In MA transactions, buyers oftentimes hold back a percentage of the purchase price ((ypically 10 20 % ))or a specified period ( c(monly 12 24 months ). )is escrow arrangement proteprotectsnst:

- Breaches of representations and warranties

- Undisclosed liabilities discover post closing

- Work capital adjustments

- Tax liabilities that emerge after the transaction

The holdback provide the buyer with pronto available funds to offset any financial impacts from these issues without have to pursue the seller for compensation.

Vendor holdbacks

When businesses contract with vendors or suppliers, they may implement holdbacks until goods or services meet quality standards or performance metrics. This arrangement is common in:

- Technology implementation projects

- Manufacture supply contracts

- Service level agreements

The holdback typically ranges from 5 15 % of the contract value and incentivize vendors to deliver as promise.

Tax holdbacks

In certain transactions, peculiarly those involve international parties or complex tax situations, a portion of funds may be hold stake to cover potential tax liabilities. This ensures that sufficient funds are available to satisfy tax obligations that mightbe assesseds after the transaction close.

Real estate holdbacks

In real estate transactions, holdbacks protect buyers from issues that may be discovered after closing, such as:

- Repairs identify during inspections

- Title defects require resolution

- Environmental remediation requirements

- Tenant relate issues in commercial properties

These holdbacks typically remain in escrow until the specify conditions are satisfied or the designate time period expire.

How holdbacks are structure

The structure of a holdback arrangement typically include several key elements:

Amount determination

The holdback amount is normally calculated as a percentage of the total transaction value. The specific percentage varies base on:

- Industry standards and practices

- The level of perceive risk

- The nature and complexity of the transaction

- The relationship and trust between parties

Higher risk transactions typically warrant larger holdback percentages, while establish relationships might operate with smaller holdbacks.

Duration and release triggers

Holdback arrangements will specify both the duration for which funds will be withheld and the conditions that will trigger their release. These may include:

- Time base triggers (e.g., 12 months after closing )

- Performance base triggers (e.g., achievement of specify milestones )

- Inspection base triggers (e.g., verification of work quality )

- Documentation base triggers (e.g., receipt of clearance certificates )

Many holdback arrangements incorporate multiple release points, allow portions of the hold funds to be release as various conditions are meet.

Administration mechanisms

Holdbacks are typically administer done:

- Escrow accounts: Neutral third parties hold the funds until release conditions are meet

- Trust arrangements: Funds are hold in trust with specific instructions for release

- Direct retention: The pay party only delays payment of the holdback portion

The administration method oftentimes depend on the transaction size, complexity, and the level of trust between parties.

Legal and contractual considerations

Holdback arrangements involve several important legal considerations:

Clear documentation

Effective holdback provisions require precise documentation that clear specifies:

- The exact amount or percentage being withheld

- The specific conditions that must be meet for release

- The timeframe during which the holdback apply

- The process for resolve disputes about release conditions

- The rights and obligations of all parties regard the hold funds

Ambiguity in these terms oftentimes lead to disputes and can undermine the effectiveness of the holdback arrangement.

Regulatory compliance

Depend on the industry and jurisdiction, holdbacks may be subject to specific regulations:

- Construction holdbacks are oftentimes governed by construction lien legislation

- Tax holdbacks must comply with relevant tax laws and withholding requirements

- Securities relate holdbacks may fall under securities regulations

Failure to comply with applicable regulations can invalidate the holdback arrangement or create additional liabilities.

Interest considerations

An important negotiation point in holdback arrangements is whether interest accrue on the hold funds and, if sol, who benefit from this interest. Options include:

- Interest will accrue to the benefit of the party who will finally will receive the funds

- Interest benefit the party hold the funds as compensation for risk

- Interest being split between parties base on an agreed formula

This consideration become peculiarly significant in large transactions with substantial holdback amounts hold for extended periods.

Negotiating holdback terms

Successful negotiation of holdback terms require balance compete interests:

From the payer’s perspective

Parties withholding funds typically seek:

- Larger holdback percentages to maximize protection

- Longsighted holdback periods to allow time for issues to surface

- More stringent release conditions to ensure all obligations are meet

- Broad indemnification rights against the hold funds

From the recipient’s perspective

Parties subject to holdbacks broadly prefer:

- Smaller holdback percentages to maximize immediate cash flow

- Shorter holdback periods to reduce cash flow constraints

- Clear define and objective release conditions

- Stage or partial releases as various conditions are meet

- Interest agreement on hold funds to their benefit

Find the right balance typically depend on market conditions, relative bargaining power, and the specific risks involve in the transaction.

Holdbacks in different industries

While the basic concept remain consistent, holdbacks take on unique characteristics in different industries:

Construction industry

Construction holdbacks are deep embed in industry practice and oftentimes lawfully mandate. They typically protect against:

Source: divestopedia.com

- Substandard workmanship discover after initial inspection

- Liens file by unpaid subcontractors or suppliers

- Incomplete punch list items

- Warranty issues that emerge briefly after completion

These holdbacks commonly follow a structured release schedule tie to project milestones.

Technology and software development

In technology projects, holdbacks oftentimes relate to performance validation and acceptance testing. They may be structure some:

- User acceptance testing results

- System performance metrics

- Integration success with exist systems

- Knowledge transfer completion

These holdbacks help ensure that technology solutions deliver the promise functionality before final payment.

Manufacturing and supply chain

In manufacturing contexts, holdbacks oftentimes relate to quality assurance and volume commitments. They may be release base on:

- Quality inspection results

- Defect rates fall below specify thresholds

- On time delivery performance

- Fulfillment of minimum order quantities

These arrangements help maintain quality standards throughout supply relationships.

Benefits and limitations of holdbacks

Like any financial mechanism, holdbacks offer distinct advantages while likewise present certain challenges:

Key benefits

- Risk alignment: Holdbacks align financial incentives with performance expectations

- Simplify recovery: When issues arise, compensation is instantly available without litigation

- Verification opportunity: They provide time to verify quality and compliance before full payment

- Relationship protection: By establish clear expectations, holdbacks can really strengthen business relationships

Potential limitations

- Cash flow impact: Holdbacks can create significant cash flow challenges for recipients, peculiarly smaller businesses

- Administrative complexity: Manage holdback arrangements require careful tracking and administration

- Dispute potential: Subjective release conditions can lead to disagreements about whether requirements have been meet

- Cost implications: Recipients may inflate prices to compensate for delayed access to funds

Alternatives to traditional holdbacks

In some situations, alternatives to standard holdbacks may be appropriate:

Performance bonds

Alternatively of withholding payment, the perform party provide a bond from a surety company guarantee performance. If obligations aren’t meet, the bond can be call upon for compensation. This approach allow full payment while notwithstanding provide protection.

Representations and warranties insurance

Especially in MA transactions, insurance policies can cover the risks that holdbacks typically address. The insurance company aassumesthe risk of breaches, allow more funds to flow to the seller at closing.

Milestone base payments

Quite than withhold from each payment, the payment schedule itself can be structure to align with the completion of specific milestones or deliverables. This approach maintain the incentive structure while potentially improve cash flow.

Best practices for implement holdbacks

To maximize the effectiveness of holdback arrangements:

Be specific and objective

Clear define all aspects of the holdback arrangement, include:

- Precise amounts or percentages

- Objective release criteria that can be measure or verify

- Specific timeframes and deadlines

- Documentation requirements for prove compliance

Consider proportionality

Ensure that the holdback amount is proportionate to the actual risk being address. Excessive holdbacks can damage relationships and may be counterproductive if they create financial strain that impact performance.

Plan for dispute resolution

Establish a clear process for resolve disagreements about whether release conditions have been meet. This might include:

- Designate neutral evaluators

- Structured escalation procedures

- Alternative dispute resolution mechanisms

Document everything

Maintain comprehensive records relate to the holdback, include:

- The original agreement establishes the holdback

- Evidence of compliance with release conditions

- Communications regard the holdback status

- Release authorizations and payment confirmations

Conclusion

Holdbacks represent a fundamental risk management tool in finance, provide protection and create accountability in a wide range of transactions. When decent structure and administer, they balance the interests of all parties while ensure that contractual obligations are fulfilled.

Understand the nuances of holdback arrangements — from their basic structure to industry specific applications — is essential for anyone involve in significant financial transactions. By cautiously consider the amount, duration, administration, and release conditions of holdbacks, parties can create arrangements that efficaciously protect their interests while facilitate successful business relationships.

Whether in construction projects, corporate acquisitions, vendor relationships, or real estate transactions, the strategic use of holdbacks continue to play a vital role in modern financial practice. As with any financial mechanism, their effectiveness finally depends on clear communication, thoughtful structuring, and good faith implementation by all involved parties.

MORE FROM feelmydeal.com