Possible Finance Approval Timeline: Complete Guide to Loan Processing Speed

Understand possible finance approval timeframes

When you apply for financing, the wait period can feel endless. Whether you’re sought a personal loan, auto financing, or mortgage approval, understand typical processing times help set realistic expectations and plan consequently.

Most lenders process standard loan applications within 24 hours to 14 business days. Nonetheless, this timeline varies importantly base on multiple factors include loan type, application completeness, credit complexity, and lender efficiency.

Factors that impact approval speed

Application completeness

Complete applications move through the system fasting than incomplete ones. Miss documents, unclear information, or incomplete forms trigger delays as underwriters request additional materials. Successful applicants typically submit all require documentation upfront, include income verification, bank statements, and identification.

Credit profile complexity

Straightforward credit profiles with stable employment and clear credit histories process promptly. Complex situations require manual review take foresightful. These include recent credit events, multiple income sources, self-employment, or unique financial circumstances.

Loan amount and type

Smaller personal loans oftentimes receive faster approval than large mortgages. Secured loans typically process promptly than unsecured financing since collateral reduce lender risk. Auto loans with clear vehicle information move fasting than complex commercial financing.

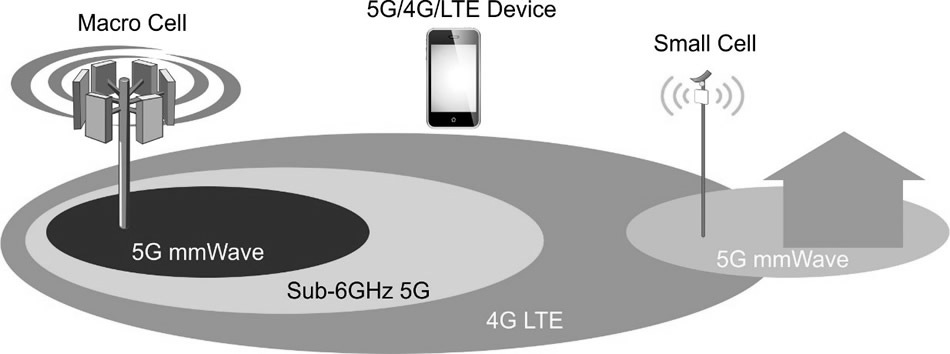

Typical processing times by loan type

Personal loans

Personal loan approvals range from same day to seven business days. Online lenders oftentimes provide faster decisions than traditional banks. Some fintech companies offer instant pre-approval with final approval within 24 48 hours for qualified applicants.

Traditional banks typically require 3 7 business days for personal loan processing. Credit unions oftentimes fall someplace between online lenders and banks, normally take 2 5 business days for member applications.

Auto financing

Auto loan approvals oftentimes happen within 24 72 hours. Dealership financing can provide same day approval, though rates may be higher than bank financing. Pre-approve auto loans from banks or credit unions typically process within 1 3 business days.

Use vehicle financing sometimes take longer than new car loans due to additional vehicle inspection and valuation requirements.

Mortgage loans

Mortgage approvals represent the longest processing times, typically require 30 45 days from application to closing. This extends timeline accommodate property appraisals, title searches, insurance verification, and comprehensive income documentation.

Pre-approval letters can be issue within 1 3 business days, but full underwriting take importantly longsighted. Complex mortgage situations may extend beyond 45 days.

Source: ar.inspiredpencil.com

Expedite your approval process

Prepare documentation in advance

Gather all necessary documents before apply. This includes recent pay stubs, tax returns, bank statements, and identification. Have digital copies promptly available speeds up the submission process.

Self employ applicants should prepare additional documentation include profit and loss statements, business tax returns, and bank statements cover longer periods.

Maintain communication

Respond quickly to lender requests for additional information. Many delays occur when applicants take days to provide request documents. Quick responses keep your application move through the pipeline.

Establish a primary contact at your lending institution and maintain regular communication about your application status.

Choose the right lender

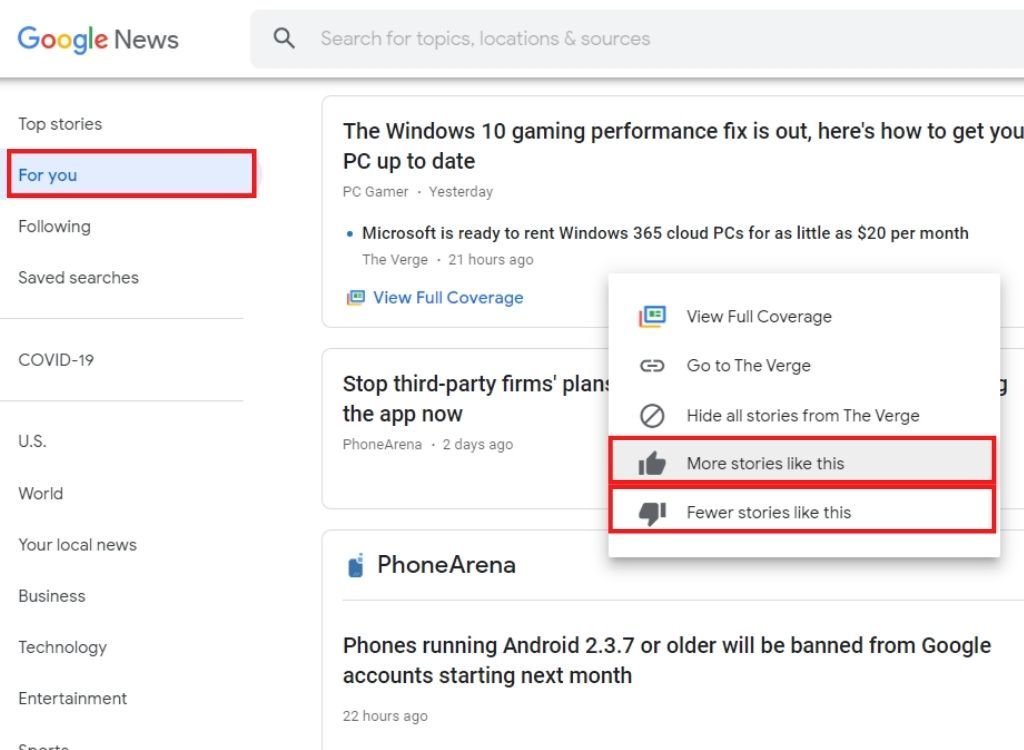

Different lenders have varied processing capabilities. Online lenders oftentimes provide faster decisions but may have stricter qualification requirements. Traditional banks offer relationship benefits but may process applications more slow.

Research lender processing times and read recent customer reviews about approval speed before submit your application.

Common delays and how to avoid them

Verification issues

Employment and income verification can create significant delays, specially if your employer is slow to respond to verification requests. Alert your hr department about potential verification calls and provide direct contact information when possible.

Bank account verification delays occur when account information is unclear or when banks take time to respond to verification requests.

Credit report discrepancies

Errors on your credit report can halt the approval process while discrepancies are resolve. Review your credit report before apply and dispute any inaccuracies good in advance of your loan application.

Recent credit inquiries or new accounts may require explanation, therefore be prepared to provide context for recent credit activity.

Property relate delays

For secured loans, property appraisals and inspections can create bottlenecks. Schedule these as betimes as possible in the process. Ensure properties are accessible for appraisers and that all necessary repairs are complete before inspection.

Digital vs traditional processing

Digital lenders leverage technology to streamline approvals. Automated underwriting systems can process straightforward applications within minutes, though complex situations ease require human review.

Traditional lenders oftentimes provide more personalized service but may have retentive process times due to manual review processes and establish procedures.

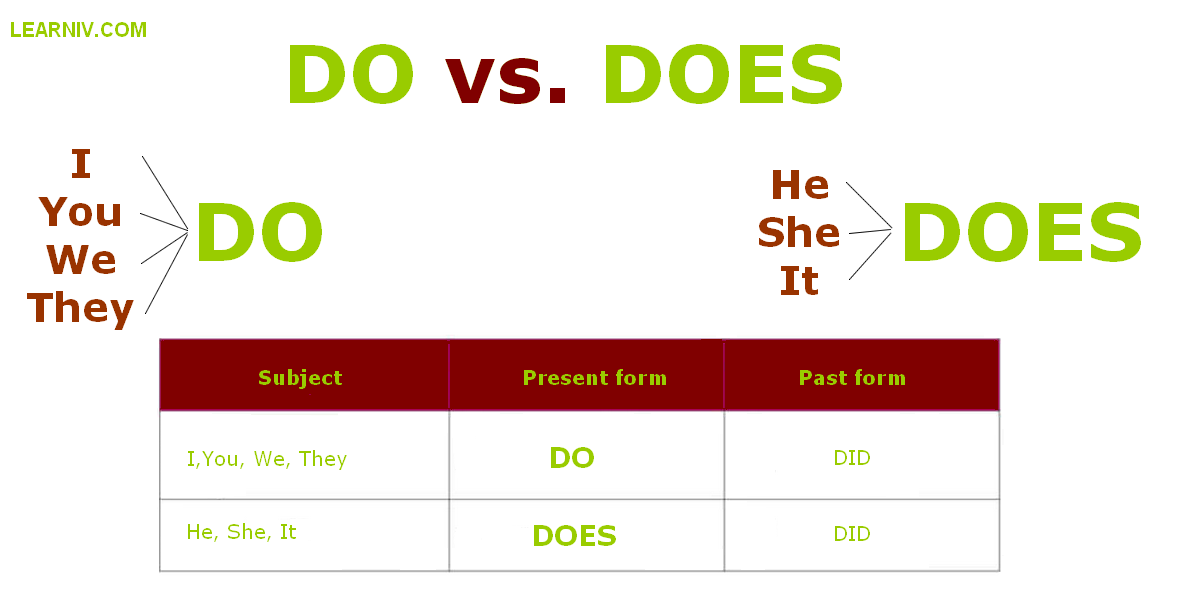

Source: YouTube.com

Hybrid approaches combine digital efficiency with human expertise, offer balanced processing times and personalize service.

Understand pre-approval vs final approval

Pre-approval provide conditional loan commitment base on initial review of your financial information. This process typically tatakes 3 business days and give you confidence to shop for vehicles or homes within your budget.

Final approval require complete documentation review and may include property appraisal, title search, and final income verification. This stage take yearn but provide definitive loan commitment.

Pre-qualification is yet faster than prpre-approvalut provide less certainty since it’s base on self report information without verification.

Seasonal and market factors

Loan processing times can vary base on market conditions and seasonal factors. High demand periods like spring home buying season or end of year auto sales may create processing delays as lenders handle increase application volumes.

Economic conditions affect approval criteria and processing times. During uncertain economic periods, lenders may implement additional review procedures that extend approval timeframes.

What to do while waiting

Avoid make major financial changes during the approval process. New credit applications, large purchases, or job changes can impact your approval status and require additional review.

Maintain stable bank account balances and continue make all payments on time. Lenders may conduct final credit checks before funding, therefore maintain financial stability throughout the process is crucial.

Use waiting time profitably by research insurance options, compare rates from multiple lenders, or prepare for loan closing procedures.

Red flags that may extend processing

Certain situations mechanically trigger extended review periods. These include recent bankruptcy, foreclosure, or other major credit events. Self-employment, commission base income, or irregular earnings patterns besides require additional documentation and review time.

Multiple recent credit inquiries, frequent job changes, or unexplained large deposits in bank accounts may prompt additional questions and extend processing times.

Maximize your approval chances

Strong credit scores importantly improve approval odds and processing speed. Scores above 700 typically receive faster processing than lower scores require additional review.

Stable employment history and adequate income relative to debt obligations streamline the approval process. Debt to income ratios below 40 % broadly process more rapidly than higher ratios.

Substantial down payments or collateral can expedite secured loan approvals by reduce lender risk.

Work with loan officers

Experienced loan officers can guide you through the process and help avoid common delays. They understand their institution’s specific requirements and can advise on documentation needs.

Maintain regular contact with your loan officer and ask for realistic timelines base on your specific situation. They can oftentimes provide updates on your application status and alert you to potential issues before they become delays.

Understand the loan approval process help set realistic expectations and enable you to take steps that expedite processing. While you can not control all factors affect approval speed, proper preparation and communication importantly improve your chances of quick approval.

MORE FROM feelmydeal.com