Sports Betting Taxes: Understanding Your Tax Obligations

Sports betting taxes: understand your tax obligations

The thrill of win a sports bet can speedily be temper by the reality of taxes. Whether you’re a casual better or someone who regularly wager on sporting events, understand your tax obligations is crucial to avoid potential issues with the internal revenue service (IRS).

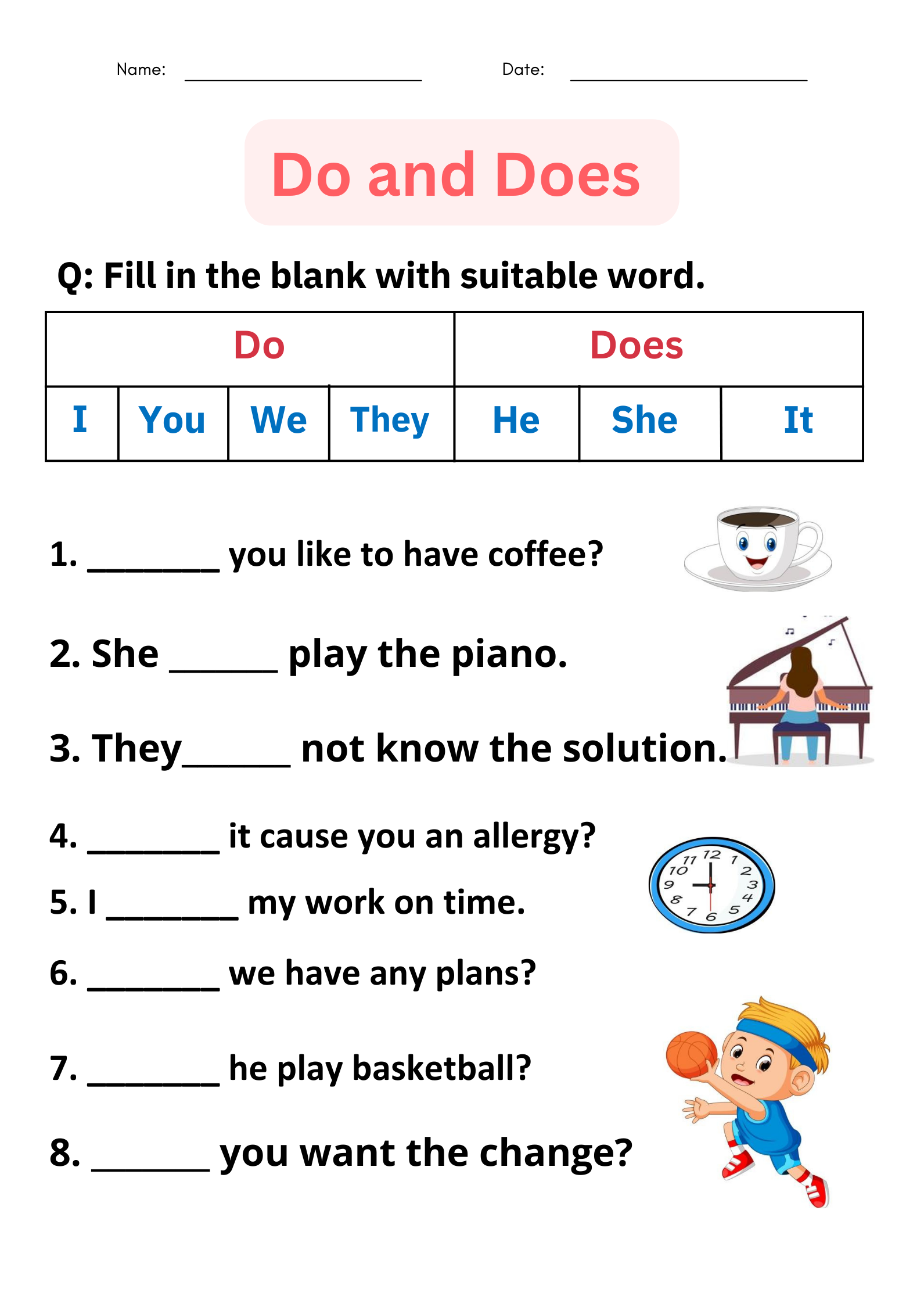

Do you have to pay taxes on sports betting winnings?

The short answer is yes. Accord to the IRS, all gambling winnings, include those from sports betting, are full taxable and must be report on your federal income tax return. This applies disregarding of whether your bet activity was through a legal sportsbook, offshore site, local bookie, or tied informal bets between friends.

The federal government consider gambling winnings as income, and like any other form of income, it’s subject to taxation. This rule apply to both professional gamblers and recreational betters, though there be some differences in how each group report their winnings and losses.

How sports betting winnings are report to the IRS

Form w 2 g

In certain situations, gambling establishments are required to report your winnings to theIRSs use form w 2g. For sports betting, this form is typically issue when:

- Your winnings are $600 or more and the payout is at least 300 times your wager

- Your winnings exceed $5,000

Tied if you don’t receive a w 2 g form, you’re stock still lawfully obligate to report all of your gambling winnings on your tax return. The IRS doesn’t have a minimum threshold for report gambling income.

Tax withholding

For large winnings, sportsbooks may withhold federal income tax at a rate of 24 %. This serve as a prepayment of your tax liability. When you’ll file your tax return, you’ll either will receive a refund if overly much was withheld or will owe additional taxes if the withholding wasn’t sufficient.

Additionally, if you fail to provide your social security number to the gambling establishment, they may be required to withhold at a higher backup withholding rate of 28 %.

How to report sports betting income on your tax return

For casual betters

If you’re a recreational sports better, you should report your gambling winnings as” other income ” n schedule 1 of form 1040. This amount is so trtransferredo your form 1040.

Casual betters can deduct their gambling losses, but solely if they itemize deductions on schedule an of form 1040. Moreover, you can but deduct losses up to the amount of your gambling winnings. For example, if you win$55,000 but lose $7,000 in the same tax year, you can but deduct $$5000 of your losses.

For professional gamblers

If sports bet is your profession, you report your income and expenses on schedule c as self-employment income. Professional gamblers can deduct not but their losses but besides ordinary and necessary business expenses relate to their gambling activities.

Notwithstanding, being classified as a professional gambler come with additional obligations, include paself-employmentnt tax and potentially make quarterly estimate tax payments.

Source: actionnetwork.com

Document your sports betting activity

Proper documentation is essential for all sports betters, particularly if you plan to deduct your losses. The IRS require you to keep an accurate diary or similar record of your gambling wins and losses, along with support documentation.

Recommended records to keep

- Date receipts or tickets from your wagers

- Payment slip from sportsbooks

- Bank statements show deposits and withdrawals relate to gambling

- Credit card statements for gambling transactions

- A detailed log of your bet activity, include dates, venues, types of bets, amount wager, and outcomes

Without proper documentation, the IRS may disallow your gambling loss deductions, which could result in additional taxes, penalties, and interest.

State taxes on sports betting

In addition to federal taxes, you may likewise owe state taxes on your sports bet winnings. State tax treatment of gambling income vary wide:

Source: wbsnsports.com

States with no income tax

If you’ll live in Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming, you won’t pay state income tax on your gambling winnings because these states don’t have a personal income tax.

States with special provisions for gambling

Some states have unique rules for gambling income:

- Arizona allow you to subtract upwards to $5,000 of gambling losses from your winnings

- Connecticut excludes the first$55,000 of gambling winnings from state income tax

- Some states, like New Jersey, allow you to deduct gambling losses but from winnings from the same type of gambling activity

States with legal sports betting

States with legalized sports bet much impose additional taxes on operators, which may indirectly affect the odds and payouts offer to betters. Still, these taxes are separate from the income tax you pay on your winnings.

It’s important to check the specific tax laws in your state, arsenic advantageously as any states where you place bets, to ensure full compliance with state tax obligations.

Special considerations for sports betting taxes

Offshore betting sites

If you bet on offshore sites, you’re nonetheless require reporting and pay taxes on your winnings. The IRS doesn’t distinguish between legal and illegal gambling for tax purposes — all gambling income is taxable.

Still, use seaward bet sites can complicate your tax situation, as these sites typically don’t issue w 2 g forms or report winnings to the IRS. This put the entire reporting burden on you, and failure to report this income could lead to significant penalties.

Fantasy sports and daily fantasy sports (dDFS)

Winnings from fantasy sports contests, include daily fantasy sports platforms like DraftKings and fan duel, areconsideredr gambling income by tIRSirs and are subject to the same tax rules as traditional sports betting.

Major fantasy sports operators typically issue a 1099 misc form for winnings of $600 or more in a calendar year.

Cryptocurrency betting

If you use cryptocurrency for sports betting, you face additional tax complexities. Not but are your gambling winnings taxable, but you may too trigger capital gains tax events when you purchase, sell, or exchange cryptocurrency for bet purposes.

The IRS require reporting of all cryptocurrency transactions, make detailed record keep peculiarly important for crypto betters.

Tax strategies for sports betters

Loss harvesting

If you’ve gambling winnings, consider realize your gambling losses before the end of the tax year to offset those winnings. This strategy, know as loss harvesting, can help reduce your overall tax liability.

Session reporting

The IRS allow for” session ” eporting of certain gambling activities, where you can report the net outcome of a gambling session instead than every individual bet. While this method is more usually apply to casino games, some tax professionals argue it can be ususedor sports bet sessions equally advantageously.

With session reporting, you’d record your net win or loss for each bet session, potentially simplify your record keeping. Notwithstanding, this approach is fairly controversial for sports betting, then consult with a tax professional before implement it.

Professional status considerations

If you bet on sports extensively, you might consider whether you qualify as a professional gambler. This classification allow for more favorable tax treatment of losses and expenses but come with stricter requirements and additional tax obligations.

The IRS look at several factors to determine professional status, include:

- Whether you approach bet in a businesslike manner

- The time and effort you put into your bet activity

- Your expertise in sports bet

- Your history of income or losses

- Your intention to make a profit

This is a complex determination that should be made with the guidance of a tax professional.

Common tax mistakes sports betters make

Not report all winnings

One of the nearly common mistakes is fail to report all gambling winnings. Remember, all winnings are taxable, disregarding of whether you receive a w 2 g form. The IRS can discover unreported income through audits, bank deposit analysis, or information from third parties.

Claim net winnings rather of gross

Another common error is report but your net winnings (winnings minus losses )as income. The correct approach for casual bebetterss to report the full amount of your winnings as income and so claim your losses individually as an itemized deduction on schedule a.

Inadequate record keeping

Poor documentation can lead to deny deductions and potential penalties. Maintain thorough records of all your bet activity, include both wins and losses.

Misunderstand state tax obligations

Many betters focus solely on federal taxes and overlook their state tax obligations, which can vary importantly depend on where you live and where you place your bets.

Consequences of not pay taxes on sports betting

Fail to report gambling income can lead to serious consequences:

Audits and examinations

The IRS may initiate an audit if they suspect unreported gambling income. During an audit, you will need to will provide documentation to will support your will report income and deductions.

Penalties and interest

If the IRS determine that you’ve underreported your income, you may face penalties for failure to pay and failure to file, plus interest on the unpaid tax. The penalty for negligence is typically 20 % of the underpayment, while the penalty for fraud can be as high as 75 %.

Criminal prosecution

In extreme cases of willful tax evasion, the IRS may pursue criminal charges, which could result in hefty fines and yet imprisonment.

Get professional help

Give the complexities of gambling taxation, consult with a tax professional who have experience with gambling income is extremely recommended, particularly if:

- You have significant gambling winnings or losses

- You’re unsure about your status as a casual or professional gambler

- You bet in multiple states or on offshore sites

- You use cryptocurrency for bet

A knowledgeable tax professional can help ensure you’re compliant with all tax laws while maximize your legitimate deductions.

Conclusion

Yes, you do have to pay taxes on sports bet winnings. The IRS consider all gambling winnings as taxable income, disregarding of the amount or the legality of the bet activity. Proper reporting and documentation are essential to avoid potential issues with tax authorities.

By understand your tax obligations, maintain thorough records, and mayhap seek professional advice, you can enjoy sports bet while stay compliant with tax laws. Remember that tax laws can change, so it’s important to stay informed about current regulations affect gambling income.

While taxes may take a bite out of your winnings, they’re an unavoidable aspect of successful sports betting. Proper tax planning can help you minimize your tax burden lawfully and avoid costly penalties down the road.

MORE FROM feelmydeal.com